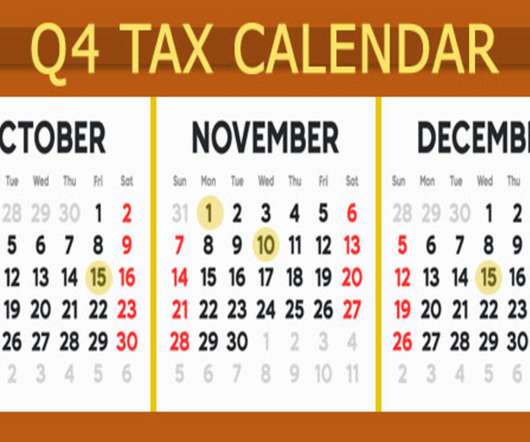

Key Q4 2021 Tax Deadlines for Businesses

RogerRossmeisl

OCTOBER 6, 2021

Friday, October 15 If a calendar-year C corporation that filed an automatic six-month extension: File a 2020 income tax return (Form 1120) and pay any tax, interest and penalties due. Make contributions for 2020 to certain employer-sponsored retirement plans.

Let's personalize your content