Small Business Tax Deductions: Pay Less in Taxes with Business Deductions in 2020

LyfeAccounting

OCTOBER 21, 2020

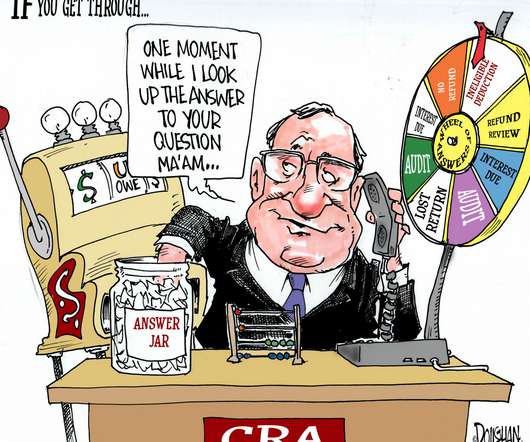

?. In federal taxes you owe $78,435.72. Look, those were like your tax liabilities from last year. So I’d say, learn how to use small business tax deductions to lower your liability. Because you definitely don’t want to spend more in taxes for another year. Because like clockwork, taxes come due every year.

Let's personalize your content