Deferring Employee Payroll Taxes

CapataCPA

SEPTEMBER 1, 2020

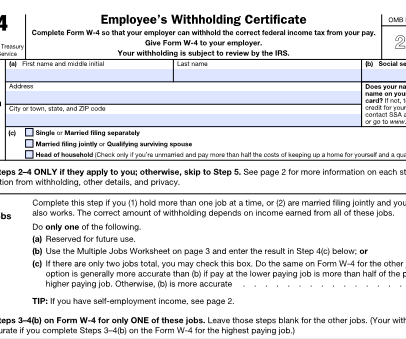

Deferring Employee Payroll Taxes The U.S. Treasury and IRS have released the initial guidance, Notice 2020-25, to put into operation the President’s Executive Order, which allows employers to defer employee payroll taxes beginning on September 1, 2020. Initial Guidelines This.

Let's personalize your content