Tax Preparer Finds Out in the Worst Way Possible That ERC Wasn’t a Free Money Glitch

Going Concern

APRIL 5, 2024

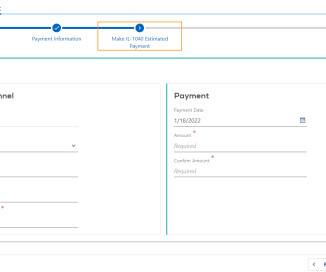

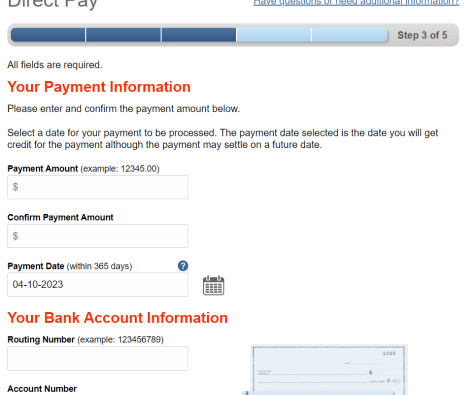

A federal grand jury in Newark, New Jersey, returned an indictment Wednesday charging tax preparer Leon Haynes of Teaneck, New Jersey with fraudulently seeking more than $150 million from the IRS by filing more than 1,600 false tax returns for himself and his clients that claimed COVID-19-related employment tax credits.

Let's personalize your content