Your Estate Plan: Don’t Forget About Income Tax Planning

RogerRossmeisl

JULY 16, 2022

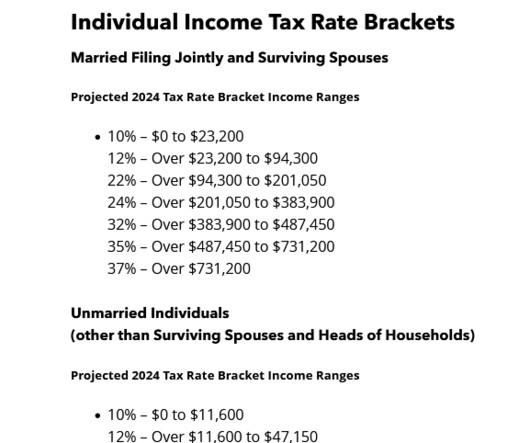

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Note: The federal estate tax exclusion amount is scheduled to sunset at the end of 2025.

Let's personalize your content