Tax Preparation Tips for 2023: Tax Tips to Prepare Your Business for Tax Season

Snyder

OCTOBER 30, 2022

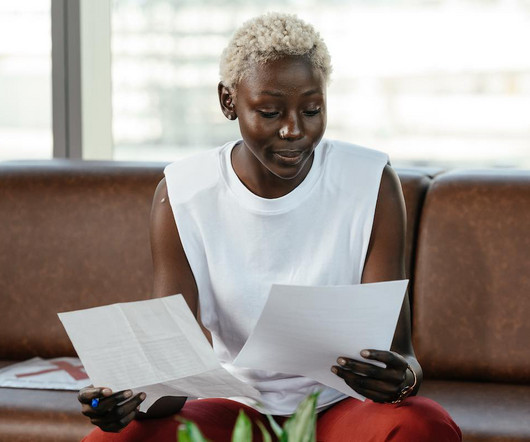

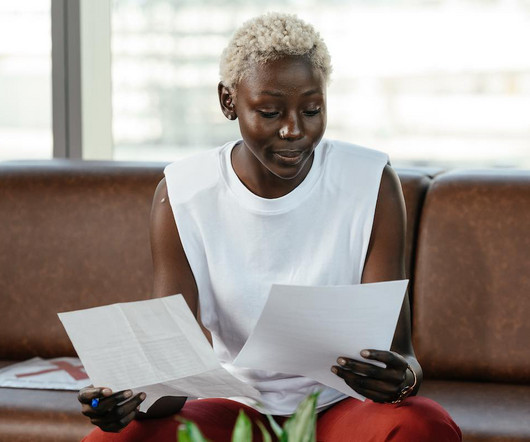

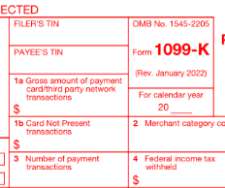

Taxes add a big chunk to this plate. Tax filing deadlines and taxes themselves become a really big deal for e-commerce business owners, adding even more stress to their busy lives. But is there a way to escape tax filing season disturbance? How much do small businesses pay in taxes?

Let's personalize your content