Understanding depreciation and its impact on corporate tax

ThomsonReuters

AUGUST 25, 2023

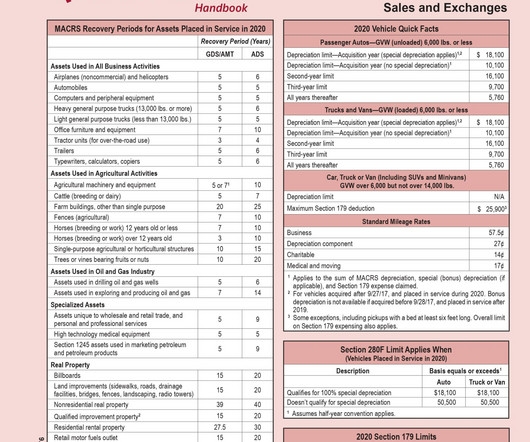

Jump to: How does depreciation affect corporation taxes? Accelerated depreciation for corporations How does depreciation work in an S corporation? What is the depreciation guidance for corporate alternative minimum tax? In short, depreciation can result in a reduction in corporate taxes.

Let's personalize your content