Using Your R&D Tax Credit Against Payroll Taxes

Shay CPA

MARCH 6, 2024

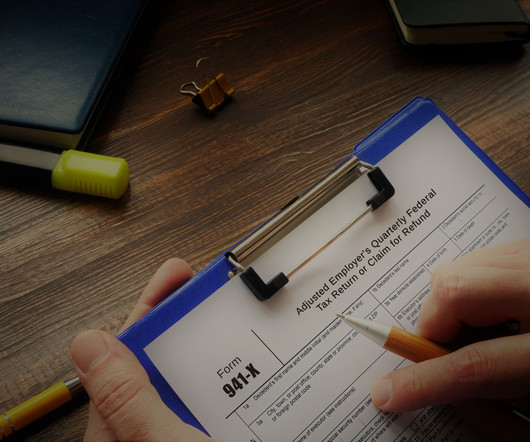

As you wrapped up the 2023 books for your startup, you probably did some high-level financial review and analysis. For most companies, payroll makes up a huge category in the latter. It’s the R&D credit that the IRS will let you apply toward payroll taxes. In other words, you can’t make this election retroactively.

Let's personalize your content