2024 Q2 Tax Calendar: Key Deadlines for Businesses and Employers

RogerRossmeisl

APRIL 17, 2024

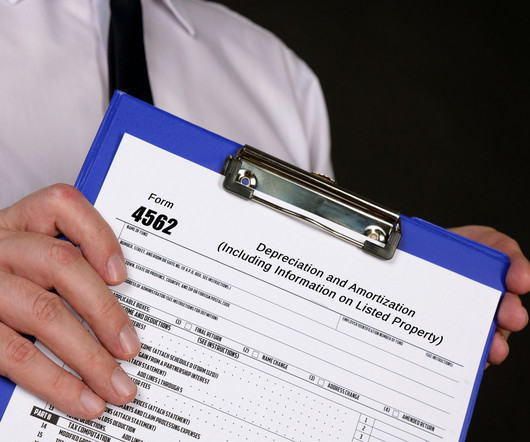

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. April 15 If you’re a calendar-year corporation, file a 2023 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due.

Let's personalize your content