2024 Tax Planning Tips from Grant Thornton

CPA Practice

DECEMBER 21, 2023

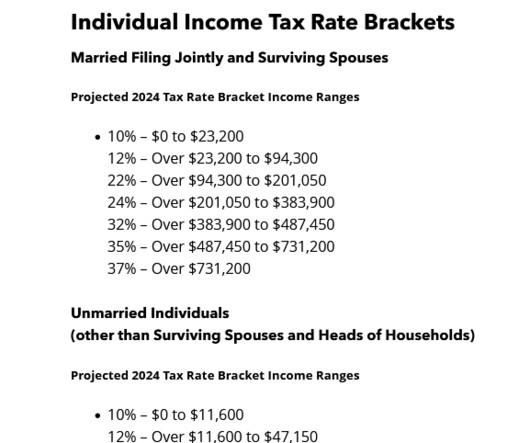

To help companies and individual taxpayers understand their planning options, Grant Thornton LLP, one of America’s largest professional services firms, has released 2024 tax-planning guides for businesses and individuals. Public companies should be preparing to report and pay a new 1% tax on stock buybacks.

Let's personalize your content