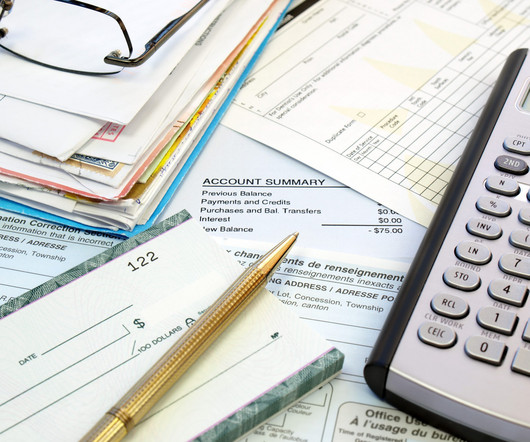

How Accounting Firms Are Winning the Automation Game

CPA Practice

SEPTEMBER 27, 2023

For accounting firms, automation gathers scattered information and turns it into valuable insights. A new report from BILL shows how accounting firms are winning at automation. Of the nearly 1,200 accountants who were surveyed, more than two in five (43%) say they are already using accounting software with automation capabilities.

Let's personalize your content