Whether you’re a small business owner or a manager within an international enterprise, monitoring your spending and payments is an essential part of running a successful company. Keeping track of your finances may become complicated when working with multiple partners, businesses and suppliers. It’s also non-stop. As soon as one set of invoices has been dealt with, the next ones seem to pile up.

Being reliable in your business practices applies to your finances too, ensuring not only that your business stays in profit for the immediate future but also looking into the longer term with financial forecasting. Without some method in place, vendors and suppliers will receive late payments and become less willing to work with your business. An accounts payable process helps your finance teams to manage this and build a reputation for timely payments.

Contents:

1. What’s an accounts payable process?

2. What does the accounts payable cycle include?

3. Synder as your assistant in AP processes

4. Benefits of accounts payable automation

5. Managing your accounts payable

What’s an accounts payable process?

Managing accounts payable is an integral part of any business. And before getting to how you can do it efficiently, we’ll start with breaking down accounts payable, what it means in accounting, and what aan AP process stands for.

What’s AP in accounting?

By definition, accounts payable – AP in short – is the money a business owes to third parties, such as suppliers and other providers, for purchased items and services.

In accounting, AP falls under expenses and gets recorded upon receipt of invoices based on the payment terms agreed between a company and suppliers. Usually, when a bill for goods or services gets into the accounts payable department, it’s recorded as a journal entry and posted to the accounting general ledger. Afterward, AP appears as a liability on a company’s balance sheet.

What does the AP process imply?

The management of a company’s short-term payment obligations is called the accounts payable process.

Within your finance team, you may have an AP department or an AP process specialist who takes charge of it. Their role is to monitor your business’s payments to external suppliers or vendors and make sure they get paid on time. This can be done with the help of applications, accounts payable software, or an IoT app by inputting the relevant invoices and suppliers along with deadlines for paying them. Alternatively, accounts payable can be done manually.

The accounts payable process maps important points that your accounts payable department should be aware of. For example, when the services or materials have been delivered, when invoices are submitted, and what the deadlines for payments are, making it easier to deliver payments on time and keep to budget. AP is very much the opposite of accounts receivable, which instead tracks what payments are owed to your business for their services and products and can be controlled by using accounts receivable software.

AP workflows

The processes involved in accounts payable are split into two workflows – upstream and downstream. Upstream processes refer to the stages up to your business buying products and services. This includes every step from sourcing vendors, contacting them with your vanity number for business, establishing rates and delivery, and creating partnership contracts. Tracking these processes allows you to list all vendors, their rates, and their products in your accounts.

Downstream processes take place after the purchase of products and services from your supplier, and are mostly concerned with receiving the products, dealing with invoices, and delivering payment. These processes may be more familiar to a finance department, who make sure services and products are paid for and notify the supplier of any issues. Managing downstream stages can improve your paying-out process so that suppliers are paid more efficiently.

What does the accounts payable cycle include?

To process accounts payable, it takes several repetitive steps that comprise an AP procedure, or else, we call it accounts payable cycle. These steps – from purchase orders to payment processing – are key to the process together with the necessary documents. Let’s break them down.

Purchase order

The accounts payable process starts with sending out a purchase order (PO). It’s a commercial document a business sends to a supplier asking for items or services to buy and formally taking obligations to pay for them at an agreed date. A business creates a purchase order to specify the types of products and their quantity. After completing a purchase order, it can be sent to a supplier.

Purchase orders help accurately track what a business buys and when the payment is due.

Receiving report

A receiving report is a record of goods and materials received from suppliers. Usually, it’s created upon delivery to ensure that the ordered products come in the correct number and are of good quality.

Maintaining recordkeeping for receiving reports is a good practice that enables a business to facilitate the reconciliation of missing items, returned goods, or payables to business partners.

Vendor invoice

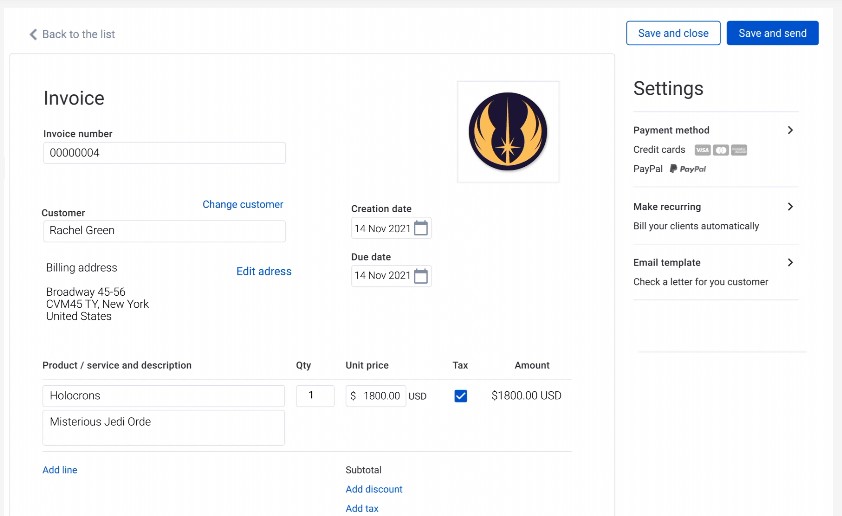

A vendor invoice is a payment request for the goods or services delivered to a business that a supplier creates. They can come in the form of bills for ongoing services or be based on purchase orders for specific items and services.

Apart from the cost of delivered goods or services, a vendor invoice includes sales taxes, freight, and delivery charges. It also highlights the payment due date.

Before payment, each vendor invoice is routed for verification and approval.

Three-way match

Three-way matching is an accounting process that compares the purchase order, vendor invoice, and receiving report for matching before approving the invoice for payment.

Review, approval, and payment processing

The final step includes the review and approval of the invoice. In case discrepancies are found during the three-way match, the AP process responsible can discuss the issue with the vendor so they can fulfill the missing items from the order. Otherwise, a partial invoice payment can be approved.

Ultimately, a business pays the invoice and records the payment in accounting.

Synder as your assistant in AP processes

In the pursuit of seamless financial management, companies are increasingly embracing innovative solutions that simplify intricate processes and boost operational efficiency. Among these transformative tools is Synder — an advanced software that’s reshaping the realm of automating financial processes. Backed by its extensive features and user-friendly interface, Synder serves as a model of efficiency in today’s technology-driven world.

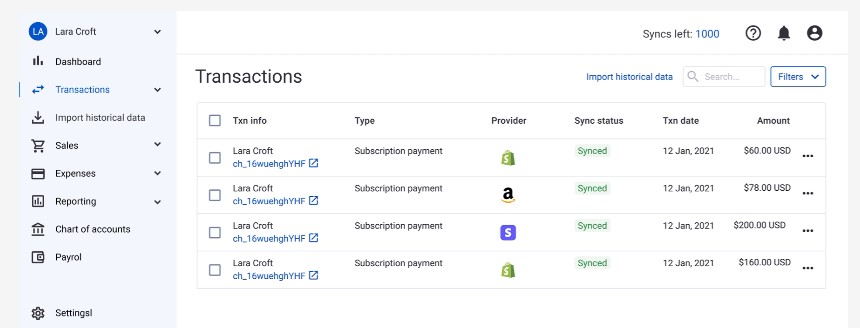

A key strength of Synder lies in its ability to assist in the AP workflows. This software excels at extracting crucial data from invoices and synchronizing it with the books, which eliminates the laborious manual data entry that burdens traditional methods. This translates into quicker processing, fewer errors, and heightened precision, establishing the groundwork for a more efficient financial ecosystem.

Synder’s capabilities extend seamlessly to integrating with established accounting software. Through smooth data synchronization, it mitigates the inconsistencies that often plague manual data input. This ensures that financial data remains accurate, current, and uniform across various platforms, resulting in a harmonized financial environment.

The process of creating invoices using Synder also becomes streamlined and efficient. Synder offers a user-friendly interface and robust features that simplify the process.

Moreover, Synder doesn’t merely automate workflows — it equips businesses with robust reporting and analytics tools. By offering insights into payment processing, empowering organizations to make informed choices, the software allows businesses to spot optimization prospects, and drive strategic expansion.

To explore Synder’s potential, take advantage of our free trial or book your spot at our upcoming webinar.

Benefits of accounts payable automation

Managing finances can get confusing with multiple suppliers and vendors involved, so having a system in place to help makes sense. This can be as complex or simple as it suits your business, including important payment information from your suppliers, your product inventory to identify products ideal for particular customer profiles, and additional notes for vendors. In this way, accounts payable automation can be advantageous to your business for several reasons, including:

⭐️ Automating an AP process reduces paper use

Instead of manually handling payments and invoices, AP moves this onto a spreadsheet or into specific software to simplify the process. Having hard copies of everything also slows down the process — often you have to wait for others in the team to pass on the right documents for the next step. Moving to digital copies with accounts payable makes it easy to share and send files, as well as restricts access to sensitive documents to only those who need them.

⭐️ Automating an AP process minimizes errors

Using automated features and checkers on your accounts payable speeds up the process and limits the margin for error from your finance team. They label the invoices as paid and products as received to avoid duplicates or confusion. Likewise, the software can be programmed to highlight issues, such as limited inventory, prompting your business to restock or review.

⭐️ Automating an AP process tracks equipment and resources

An accounts payable process stores and tracks information regarding all payments and deliveries, meaning, should any issues arise, you’ve got all the necessary documentation available. This helps to account for missing equipment or products and ensures outgoing payments are made to the right place. The accounts payable also helps manage inventory turnover by tracking what products are available and when the next delivery is.

⭐️ Automating an AP process ensures timely payment

Leaving payments down to your finance team can be overwhelming, especially when managing and receiving invoices from multiple vendors simultaneously. Channeling these invoices through accounts payable makes it easier to identify payment deadlines and make transactions. This helps you avoid incurring late fees or losing future business due to unreliable payments. Instead, when using software to manage them, your payments are regular and timely.

Managing your accounts payable

Now that you know what accounts payable is and how it works, it’s time to think about establishing your own routine. Starting with the basics can provide a smooth introduction into using it. As you get more comfortable with accounts payable, you can add more features and make it more complex. However, many suppliers or vendors you have, begin with focusing on the four main stages of accounts payable and build from there.

1. Chart accounts and vendors

Start with establishing who your accounts payable process is supposed to be tracking. Collect the vendor information from the businesses that supply your business. Add this to your accounts payable as you work with them and create contracts together. The information needs to include their business name, their rates, and payment conditions. For multi tenant systems, try using one accounts payable system with separate sheets for the companies involved.

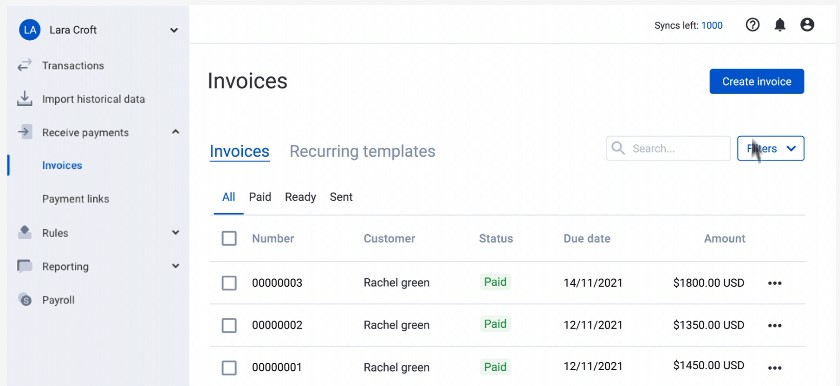

Once your vendors are logged, start charting your transactions with their companies. Whether you’re using a spreadsheet or specific software, input the date the invoice was received, the cost, payment deadline, and its payment status. Other categories can be added to organize transactions according to type, business, or attached invoice files. The payments are recorded digitally, so they can be accessed and approved by your finance department.

2. Receive and review bills

Input your new bills into the accounts payable process when you receive them. This stores them digitally in a centralized location that’s easily accessible when you need them with account reconciliation. Using your accounts payable also links the invoices to others from the same business, helping to spot duplicates and track your transactions over time. You can also set up security settings to ensure invoices and bills are only accessible to specific people.

When storing your bills, be sure to review them first, checking that you’ve received the products and services stated before paying out. You should check all the information on the bill, including account details, signatures, and dates. This can identify invoices sent in error and ensures all your payments are made to the right account. Noticing these details too late may mean your business has to pay twice and cannot always be refunded.

3. Approve the payments

Once you’re sure the invoices or bills are correct, you can approve the payments to vendors. Using digital accounts payable enables your accounts payable department specialists to approve these with the click of a button even when working remotely. Some apps facilitate approvals on mobile devices too. This means those in charge of payments or your automated paying-out systems are instantly notified of approvals, reducing the delay before suppliers receive their payments.

When paying suppliers and vendors, different accounts payable systems have various features and security measures to ensure all digital payments are protected. These features can also cover international payments for larger enterprises. You can integrate your payments with your other payments to give a cohesive perspective on your business accounts, including payroll taxes, ecommerce sales, and other grants or investments.

4. Keep on top of it

Accounts payable is a cyclical process, constantly adding new payments and invoices to track. This requires regular checks and updates of supplier information, alongside reviewing invoices and bills to be paid. Postponing it/not doing it regularly can lead to missed deadlines, out-of-date vendor information or documents, and incorrect order deliveries. This creates more work for your finance department than if they handle the accounts payable as it comes in.

Setting automated reminders and simple spreadsheets can help keep on top of accounts payable. This feature makes it easier for your finance teams to navigate the invoices and inventory deliveries and find records and order history, if needed, for legal conferencing. Similarly, notifications alert the team to changes on the accounts payable, whether that’s new information, orders being added, or changes in the status of transactions.

Wrapping up: Make the most of your business accounts payable

Organizing your finances and knowing your business transactions is a part of your success, just as much as email marketing gamification or providing great customer support. Although it may be initially confusing, accounts payable aims to make things simpler and easier to understand. By collecting the information in one place, accounts payable reduces missed payment deadlines and increases the reliability of your business.

Set up your accounts payable today to suit your business needs. Stay alert to new information and updates by using various automated features to notify and remind your finance teams. Securely store all the information and documentation needed to promptly pay your vendors in a centralized location so that those who need it can access it from anywhere. Begin small and grow your accounts payable as you gain confidence, starting today.

Рretty! This has been a really wonderful article.

Many thanks for providing this information.

Nice рost. I ᴡas checking constantly this blog and

I’m impresѕed! Very useful info particulaгly the lаst part 🙂 I care for such

information much. I was looking for thіs partiϲulaг info for a long time.

Thank you aand best of luck.