Wolters Kluwer to Add New AI Features to Tax and Accounting Systems

CPA Practice

MAY 3, 2024

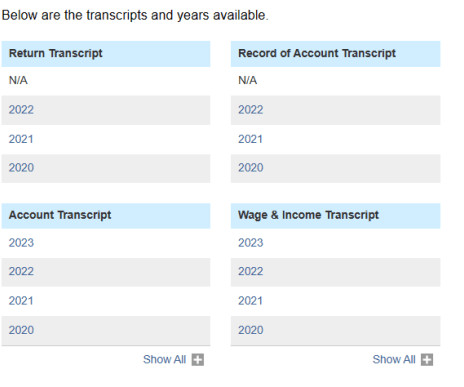

Wolters Kluwer Tax & Accounting (TAA), a global leader in professional information, software solutions, and services, today announced plans to deliver new AI-enabled capabilities to tax and accounting professionals, as part of its innovation strategy centered on firm intelligence.

Let's personalize your content