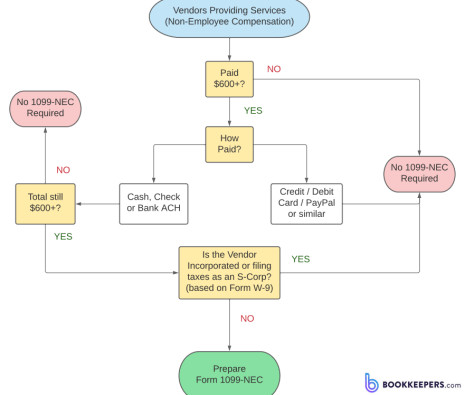

New Sole Proprietors, LLCs, and Corporations Need Accounting and Tax Services

MyIRSRelief

OCTOBER 2, 2023

There are a number of different accounting and bookkeeping software programs available for sole proprietors. These programs can help you track your income and expenses, generate financial reports, and file your taxes. This is because LLCs are separate legal entities from their owners.

Let's personalize your content