Give yourself a pat on the back. Owning and operating a small business is no small feat. What if we told you you could be leaving hard earned money on the table and there was something you could easily do about it?

An alarming amount of business owners are not taking advantage of a major federal tax saving filing status, s-corporation. I know you’re thinking – what’s the catch? In this article, we will go over the numerous benefits and some caveats of changing your filing status. If you are making over $20,000 in annual profit a year, listen up. You are probably overpaying your taxes.

Let’s dive into how an s-corporation (s-corp for short) works. The key feature that makes an s-corp different is the tax advantages it offers. S-corps are a tax structure or a tax filing status, that allows pass-through taxation for small businesses and exempts their dividends from self-employment tax. We’ll unpack this for you.

An s-corp is not an entity – that is your LLC or your corporation. An s-corp is a tax filing status with the IRS.

Understanding the difference between a business entity and a tax filing status.

Before moving on, it’s important that you understand the difference. You set up your business entity by registering it with the secretary of state. You can then choose which tax filing status you want. Your entity could be an LLC, while your filing status could be an s-corp. Therefore in this example; you would have an LLC taxed as an s-corp.

What’s the benefit?

S-corp status exempts business owners from getting taxed on their profits from self-employment tax…thats the elimination of 15.3% tax on your business profits!

But how?

Rather than paying 15.3% self employment tax on S-Corp profits, business owners pay themselves a “reasonable salary” by issuing themselves a W-2. Yes, you will need to pay social security & medicare taxes on your W-2 income, but by running some of your profits through Owner payroll, the entire remainder of your net income is saved from paying ANY self employment tax. Even better, the business can write off your salary and it’s portion of your payroll taxes. Say goodbye to 15.3% self-employment tax on your profit! If you file your taxes as a single member LLC you WILL pay 15.3% self employment tax on your entire profit…that is one of the highest tax rates paid by any American.

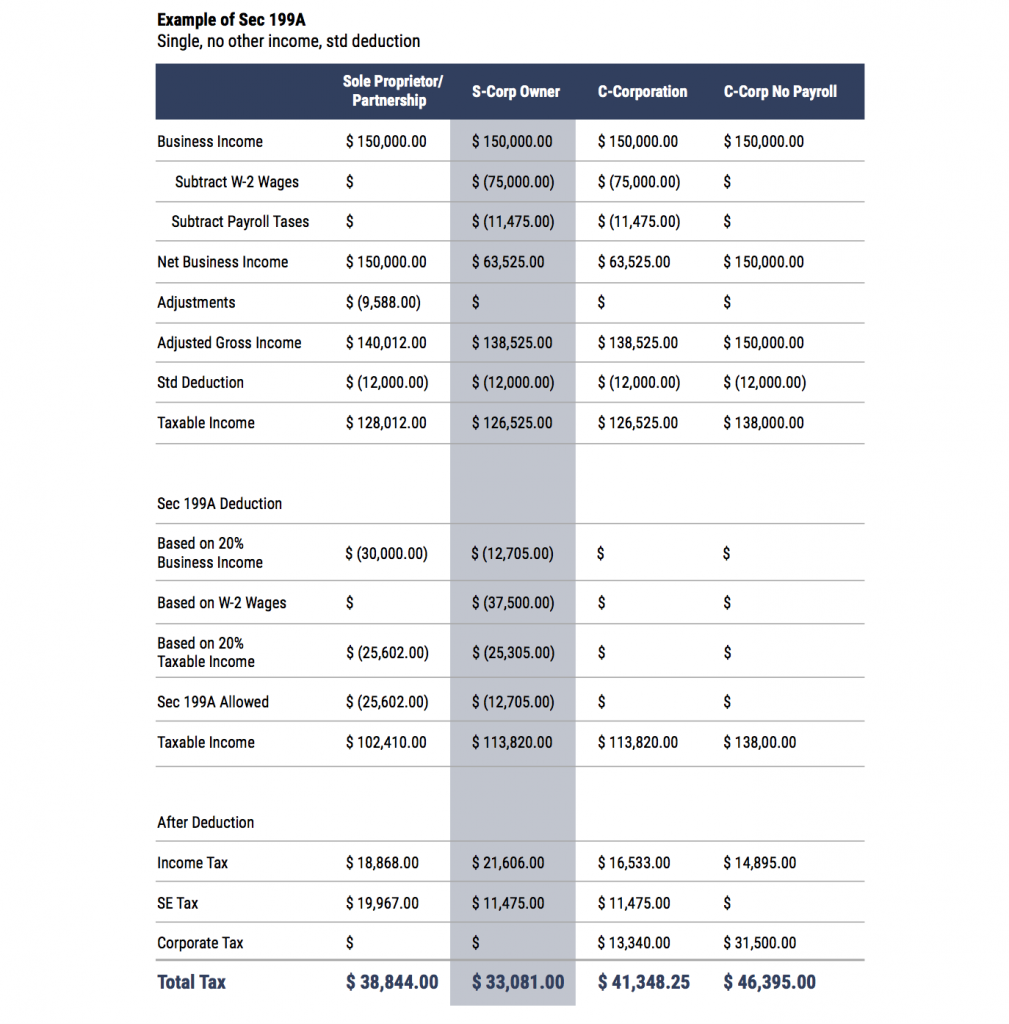

Confused? We prefer visuals. Take a look at the example graphic below. For simplicity, this person is single with no other income. We compare the different business structures and how much taxes this business owner will pay based on filing status.

If you’re still with us, you can see that this business saved between $5000-$13000 in taxes for electing to become an s-corp. That is a BIG difference. Think of all the things you could do with that extra cash. Put it back into the business, save it for a rainy day, take a trip to Europe (Yolo!).

But seriously, what’s the catch?

Like all great things, this one is going to take a little effort and a proficient accountant. Changing the tax filing status of your company is complex and requires a professional. However; once the leg work is done, the tax savings and simplicity is worth every penny. Keep in mind, you must agree to meet accounting and tax related compliance tasks.

This is our specialty at Singletrack Accounting. We offer affordable accounting for small businesses to take advantage of these tax savings. The amount you will save, even after the costs of accounting services is typically thousands of dollars. We make sure all the accounting compliance requirements are done with low cost done-for-you packages.

There are a few steps to conversion.

Steps to s-corp conversion

1- Ensure eligibility

2- Financial & Service Ramifications

3- Create a Business Entity

4- Apply for an EIN and file Form 2553 with the IRS

5- Changes to Bookkeeping

6- Changes to Tax Filing

Top compliance requirements

1- Owner W-2

2- Separate personal and business bank accounts

3- Separate corporate tax returns

4- Updated operating agreement

This may sound like a lot, but not to worry. We work with you every step of the way.

Late to the party?

You may be wondering if it’s too late to take advantage of the tax savings in this fiscal year. Let’s talk about late s-corp elections. Many s-corps miss the deadline, but fortunately for you it’s not too late. Filing for an s-corp is tricky enough, filing for a late s-corp election is even trickier but still possible. At Singletrack Accounting, we do the heavy lifting ensuring we follow all compliance measures to get you on track to change your filing status and in return save you thousands.

Takeaway

Running a small business is hard enough! Make it easier on yourself by taking advantage of this no brainer tax savings strategy. Professionals are here to make the process run smoothly. We take the heavy lifting off of you so you can do what you do best – run your business.

Reach out today to our team of experts to set up a free consultation. We have saved business owners multiple thousands of dollars over the years. Our bread and butter is s-corp election for small businesses and we are ready to help you.

How Small Businesses Can Compete With Big Brands

Recent news has been calling out big tech such as Facebook for it’s ethical choices in the face of a whistleblower who ousted the company for repeatedly choosing profit over people and buying out [...]

Disaster Prep Your Business

Fires, floods, hurricanes, earthquakes, and extreme weather are threats we are experiencing more regularly due to climate change. This is getting close to home. We have been watching the Caldor fire ravage through California [...]

Celebrate the Wins!

We constantly talk about how businesses and entrepreneurs can be better. This includes how to run your business better, how to run your accounting better, how to have more motivation, and more. We rarely [...]

The Startup End Game

The hardest part about starting a business is starting. We have talked a lot about how to make the leap into entrepreneurship but we rarely talk about the end game. If you haven't also [...]

How Biden’s Proposed Tax Bill Will Affect Small Businesses

The new presidential administration has proposed a large new tax bill to offset other priorities such as improving infrastructure, funding the American Rescue Plan, combating employment inequality and tackling climate change. These are expected [...]

Q&A With A Founder

At Singletrack Accounting, we love hearing from happy small business owners that our team has saved time, headaches, and the stress of the dreaded tax filing season. In addition, as entrepreneurs ourselves, we enjoy [...]