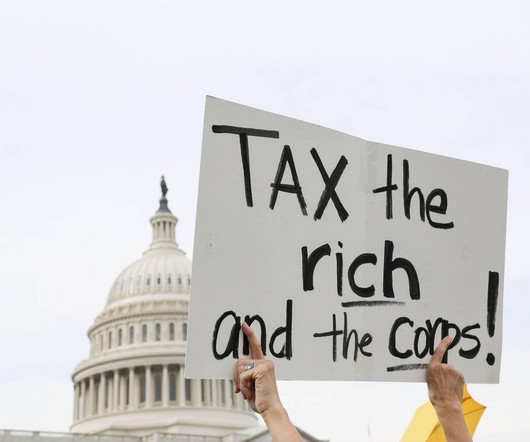

U.S. Corporate Taxes Likely to Rise to Tame Deficit, Buffett Says

CPA Practice

MAY 7, 2024

taxes are likely to rise as lawmakers look to narrow the federal deficit, Warren Buffett said, as Washington prepares for major tax negotiations next year. Higher taxes are quite likely, and if the government wants to take a greater share of your income or mine or Berkshire’s, they can do it. We think it’s appropriate.”

Let's personalize your content