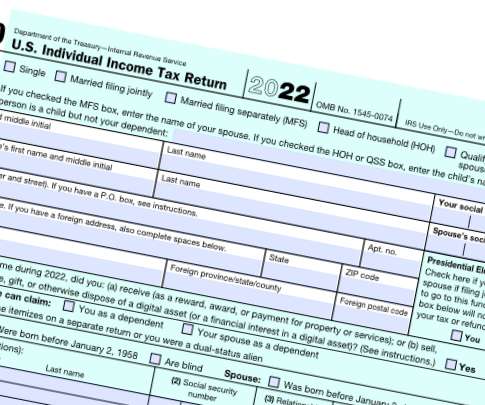

IRS Says State Issued Stimulus Payments are Not Taxable

CPA Practice

FEBRUARY 11, 2023

The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns. Other payments Other payments that may have been made by states are generally includable in income for federal income tax purposes.

Let's personalize your content