Payroll Taxes Demystified: A Breakdown for Accountants and CPAs Serving Business Owners

CPA Practice

APRIL 9, 2024

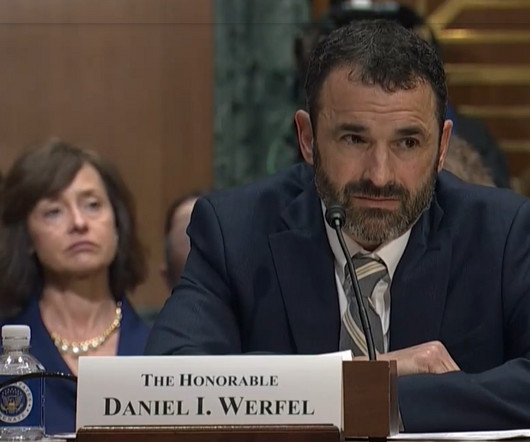

These taxes fund social insurance programs such as Social Security, Medicare, and unemployment benefits. Here’s a quick breakdown of payroll taxes: Federal Income Tax Withholding : Employers must withhold federal income tax from employees’ wages based on their W-4 Forms and Internal Revenue Service (IRS) guidelines.

Let's personalize your content