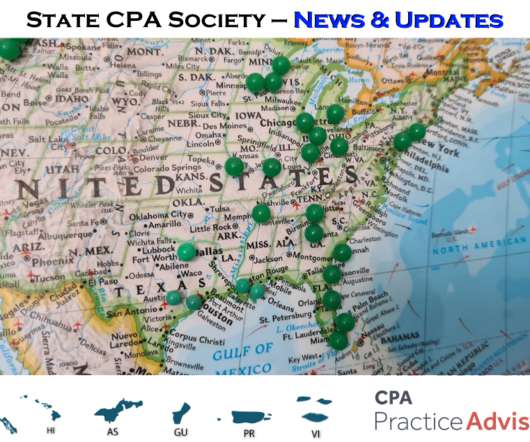

The Beef Between the AICPA and Minnesota Over the 150 Hour Rule Heats Up

Going Concern

FEBRUARY 24, 2023

That’s sort of what’s happening in the profession right now over proposed legislation in Minnesota that offers an alternative to the traditional 150 units of education required for licensure. That’s not to say Minnesota sucks, rather they are going up against the behemoth that is the AICPA.

Let's personalize your content