Using Tax Return Information in Divorce Cases

FraudFiles

MAY 20, 2024

Income tax returns and supporting information such as W-2s and pay stubs are the most common and basic documents which evidence income in family law cases.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

FraudFiles

MAY 20, 2024

Income tax returns and supporting information such as W-2s and pay stubs are the most common and basic documents which evidence income in family law cases.

Ronika Khanna CPA,CA

MAY 3, 2024

Despite your (and/or your accountants’)best efforts , occasional errors or omissions relating to your personal tax return are unavoidable. It is possible that you forgot to include a tax slip, overstated your expenses or was unaware of a specific tax credit. the new home buyer’s credit or the hybrid car tax credit.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

FEBRUARY 28, 2024

The IRS started accepting and processing income tax returns on January 29, 2024. The deadline to file returns in 2024 is April 15 (this sometimes varies based on weekends or state holidays). This article includes a handy reference chart taxpayers can use to estimate how soon they may get their income tax refund.

RogerRossmeisl

JANUARY 26, 2022

The IRS began accepting 2021 individual tax returns on January 24. If you haven’t prepared yet for tax season, here are three quick tips to help speed processing and avoid hassles. Tip 1 Contact us soon for an appointment to prepare your tax return. Tip 2 Gather all documents needed to prepare an accurate return.

Cherry Bekaert

JULY 14, 2023

More and more states treat software-as-a-service (SaaS) or platform-as-a-service (PaaS), hosting services and other data-processing services as taxable services and subject to sales tax, which shouldn’t be ignored. However, state income tax issues for PTEs generally receive less attention in the technology industry.

Snyder

JUNE 9, 2022

For e-commerce business owners, income tax filing season marks the start of a highly stressful time. Among the taxes that e-commerce businesses need to file, income tax is the most common one. To help you meet the income tax filing season fully armed and prepared, we have compiled a step-by-step guide.

Going Concern

JANUARY 10, 2024

Today in clients behaving badly, the DoJ announced Friday that Las Vegas restaurateur Raul Gil, who owns and operates three Casa Don Juan restaurants in the city, is headed to prison for 37 months for evading his federal income taxes.

Ronika Khanna CPA,CA

APRIL 19, 2024

Residents of Canada are required to reflect all sources of worldwide income on their personal tax returns. It is important, if you have investment income in non registered investments (i.e. not TFSA, RRSPs or FHSAs), to ensure that you have received all tax documents and report them.

Anders CPA

FEBRUARY 27, 2024

Key Takeaways: To file a deceased person’s tax return, you will need to file Form 1040. Begin the process by obtaining the necessary tax forms. Next, gather all relevant financial documents, such as W-2s, 1099s and any other sources of income or deductions.

CPA Practice

OCTOBER 30, 2023

The agency also permitted the receipt and transmission of documents via email during compliance interactions. 31, 2023, because they were well-received by tax professionals and taxpayers, the IRS noted. Estate Tax Return for Qualified Domestic Trusts Form 706 Schedule R-1, Generation-Skipping Transfer Tax Form 706-NA, U.S.

FraudFiles

MAY 23, 2022

One of the most common financial documents reviewed in a divorce or child support case is the income tax return. Tax returns don’t seem all that exciting, and appear to just be a record of what was earned by a party. General Sales Taxes – This could point to the purchase of substantial assets.

CPA Practice

JANUARY 8, 2024

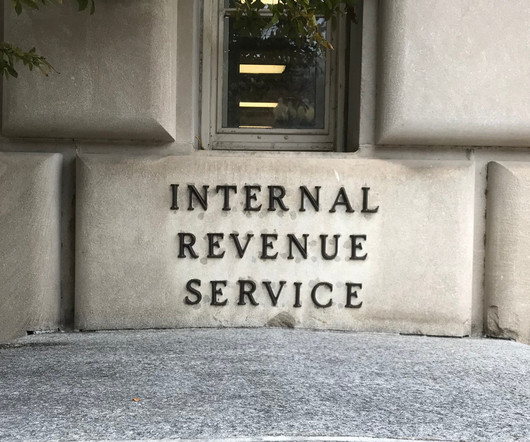

The IRS has announced that it will start accepting and processing tax returns on Monday, Jan. million individual tax returns to be filed by the April 15, 2024, tax deadline. Although the IRS will not officially begin accepting and processing tax returns until Jan. The agency expects more than 128.7

CPA Practice

APRIL 5, 2024

(TNS) A Kennewick tax preparer cost the United States $42 million in lost tax revenue between 2017 and 2020 after filing tax returns that were riddled with errors, fabrications and fraudulent entries, alleges the Department of Justice. The Department of Justice filed a civil complaint in Eastern Washington District U.S.

FraudFiles

MAY 2, 2022

Miles Mason, a Memphis divorce attorney, has a great article on his blog called Grab the Documents: What Spouses Need to Copy for Divorce Lawyers. Divorcing spouses always wonder what documents they need to take, and the list provided by Miles is a great roadmap. Documents are going to include both paper and digital records.

FraudFiles

OCTOBER 19, 2021

Tax returns can be one of the most important pieces of information a forensic accountant evaluates in a divorce case. Of course, there are other very important financial documents, but income tax returns provide summary information about of lot of financial issues, including income, expenses, and assets.

MyIRSRelief

MARCH 15, 2024

In the bustling city of Whittier, California, individuals and businesses alike face the daunting task of navigating the complex world of taxes. From unfiled tax returns to unpaid back taxes, and from employment 941 payroll issues to the intimidating process of IRS, FTB, EDD, and CDTFA audits, the challenges can seem insurmountable.

CPA Practice

FEBRUARY 1, 2024

The IRS started accepting and processing income tax returns on January 29, 2024. The deadline to file returns in 2024 is April 15 (this sometimes varies based on weekends or state holidays). This article includes a handy reference chart taxpayers can use to estimate how soon they may get their income tax refund.

CPA Practice

FEBRUARY 21, 2023

The IRS and the Treasury Department on Tuesday issued final regulations pertaining to companies filing returns and other documents electronically starting in 2024. The final regulations also create several new regulations to require e-filing of certain returns and other documents not previously required to be e-filed.

MyIRSRelief

JANUARY 2, 2023

Some common tax problems include: Failing to file a tax return: If you fail to file a tax return (1040, 1120, 1065, 941, etc.), you may be subject to penalties and interest on failure to file and on any unpaid taxes. Amending your tax returns could correct these errors.

Canopy Accounting

FEBRUARY 1, 2024

Income Tax Return for Estates and Trusts , documents the income an estate earns after the estate owner passes away. It’s also used to track income before any beneficiaries receive designated assets. For estate planning and taxation, IRS Form 1041, U.S.

CPA Practice

DECEMBER 26, 2023

It’s almost January, which means the 2024 income tax filing season is coming soon. Although last minute tax law changes can have an impact, the IRS usually starts accepting e-filed income tax returns in the last week of January each year. Updated: Dec. 26, 2023 , 9:31 pm ET.

CPA Practice

NOVEMBER 22, 2023

December is here, which means the 2024 tax filing season is coming soon. The IRS usually starts accepting e-filed income tax returns in the last week of January each year, with the deadline being April 15 (which can vary based on weekends or state holidays). tool on the IRS website to check the status of your refund.

CPA Practice

JANUARY 29, 2024

The Internal Revenue Service opened the 2024 tax season on January 29, 2024, accepting and processing federal individual tax returns, and announcing that it expects more than 146 million individual tax returns for 2023 to be filed this filing season. Online Account.

Withum

MARCH 7, 2024

We are now seeing the IRS issue standardized information and document requests (IDRs) from a centralized office in Austin, Texas. Should I File a Protective Income Tax Refund Claim? To prevent this, taxpayers can file a protective income tax refund claim. Is There Legislation Pending That Would Alter the ERC?

CPA Practice

JANUARY 8, 2024

The IRS has announced that it will start accepting and processing income tax returns on January 29, 2024. The deadline to file returns in 2024 is April 15 (this sometimes varies based on weekends or state holidays). It is not exact, as all taxpayers have different tax returns, documents, incomes, and other situations.

MyIRSRelief

OCTOBER 30, 2023

Income Tax Return for Estates and Trusts, is a complex tax form that is used to report the income and expenses of estates and trusts. Trust tax preparation can be a challenging task, even for experienced tax preparers. Third, a tax preparer can help you to avoid costly tax penalties and errors.

CPA Practice

DECEMBER 15, 2023

It’s almost January, which means the 2024 income tax filing season is coming soon. Although last minute tax law changes can have an impact, the IRS usually starts accepting e-filed income tax returns in the last week of January each year. Paper check refunds can take a little longer.

FraudFiles

JANUARY 13, 2022

What documents do you need? When a closely held business is being evaluated in connection with a family law case, the following business-related documents may be requested: Business ownership records (stock certificates, charters, operating agreements, joint venture agreements, corporate minutes, or other related documents).

Cherry Bekaert

MAY 3, 2024

What Is Global Tax Minimization? Global tax minimization is the process that companies follow to fully comply with the tax law in each country in which they operate in such a manner that their worldwide income tax liability is reduced to the lowest possible amount. income tax return.

CPA Practice

NOVEMBER 14, 2023

Based on prior-year filing statistics, IRS management estimated the majority of the unprocessed information returns were paper-filed Forms 1099 submitted with a Form 1096. The IRS’s decision to destroy those documents drew scrutiny from lawmakers and tax professionals. Unprocessed paper-filed tax returns exceeded 11.5

CPA Practice

JANUARY 26, 2024

23, 2024, to two years in prison for a scheme to file false tax returns, and to two years in prison for an unrelated online romance scam. According to court documents and statements made in court related to the tax scheme, Iona Coates owned and operated Bits & Bytes Accounting Services Inc.,

CPA Practice

OCTOBER 2, 2023

October 16 is this year’s deadline for taxpayers who requested additional time to file their taxes. This is often necessary for taxpayers who are still waiting on some documents before they can file their returns. However, taxes expected to be owed were required to be owed by the original April 18, 2023, deadline.

CPA Practice

APRIL 25, 2023

A South Carolina return preparer has pleaded guilty, after his jury trial had begun, to two counts of filing false tax returns. Harmon agreed that the total tax loss from his criminal conduct was approximately $320,000.

CPA Practice

APRIL 8, 2023

It’s almost March, and the 2023 tax filing season is well underway. If you haven’t filed your tax return yet and are wondering how long it may take to get your refund when you do file, you’re not the only one looking for the answer. That’s without an expensive “tax refund loan” or other similar product.

Nancy McClelland, LLC

FEBRUARY 24, 2024

Luckily, recent Congressional funding to make up for years of inadequate budgets, combined with Treasury Secretary Yellen’s direction that IRS priorities should include clearing the backlog of unprocessed tax returns and improving customer service, seem to be making a difference.

CPA Practice

NOVEMBER 27, 2023

The Augusta Rule, known as Section 280A by the Internal Revenue Service, allows homeowners in any income bracket to rent out their homes for up to 14 days without the obligation to report the rental income as taxable on their tax return. For more information on Instead, visit www.instead.com.

CPA Practice

JANUARY 30, 2023

Most individual taxpayers won’t have such issues for this tax season. For clarification, the weeks leading up to the April 18, 2023 , deadline is when Americans file tax returns for income they received during the 2022 calendar year, or they can file an automatic extension, which gives them an additional six months to file.

CPA Practice

APRIL 18, 2023

By David Wichner, The Arizona Daily Star, Tucson (TNS) A tax preparer in Tucson, AZ, already awaiting trial on drug-smuggling charges has been indicted by a federal grand jury, accused of filing fraudulent tax returns to reap inflated fees. including refugees who did not speak English.

Cherry Bekaert

APRIL 18, 2023

Taxpayer claims for the federal income tax credit for Increasing Research Activities (R&D tax credit) continue to draw scrutiny from the Internal Revenue Service (IRS). Two recent court cases highlight how taxpayers can lose their R&D tax credit claims. In Little Sandy Coal v. In Scott Moore, et al.

CPA Practice

OCTOBER 16, 2023

October 16 is this year’s deadline for taxpayers who requested additional time to file their taxes. This is often necessary for taxpayers who are still waiting on some documents before they can file their returns. However, taxes expected to be owed were required to be owed by the original April 18, 2023, deadline.

CPA Practice

APRIL 12, 2023

million people across the nation (state-by-state list below) have unclaimed refunds for tax year 2019 but face a July 17 deadline to submit their tax return. billion in refunds remain unclaimed because people haven’t filed their 2019 tax returns yet. Need to file a 2019 tax return?

CPA Practice

JANUARY 26, 2023

Filing these documents timely prevents late-filing penalties for employers, helps employees file their income tax returns and prevents tax fraud. and their payroll tax returns (Forms 941, 943, 944, etc.) match the EIN the IRS assigned to their business.

CPA Practice

FEBRUARY 24, 2023

It’s almost March, and the 2023 tax filing season is well under way. If you haven’t filed your tax return yet and are wondering how long it may take to get your refund when you do file, you’re not the only one looking for the answer. The IRS Started Accepting Returns on Jan. Updated: Feb. 24, 2023: 4:41 pm ET.

LyfeAccounting

JUNE 2, 2021

Want to Know How to File an Amended Tax Return? As an accounting firm, we’ve filed our fair share of amended tax returns. In today’s post, we’ll be going over when to amend your taxes and the 5 steps to actually amend your taxes. Steps to Take When Filing Amended Tax Return.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content