How the 50 States Rank By Lifetime Taxes

CPA Practice

APRIL 5, 2024

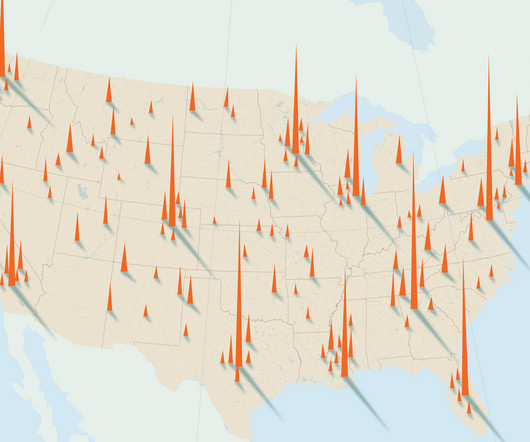

Earlier this week WalletHub released a study that shows which states’ residents have the highest and lowest tax burden , measured as the proportion of total personal income that residents pay toward state and local taxes. Another study released this week , from credit-building platform Self Financial, analyzed the lifetime cost of tax in the U.S. The study looks at how much tax the average person is estimated to pay in each state throughout their lifetime.

Let's personalize your content