AI and the firm of the future

Accounting Today

APRIL 1, 2024

Wipfli's Kelly Fisher offers a practical look at artificial intelligence and how accounting firms should be thinking about it.

Accounting Today

APRIL 1, 2024

Wipfli's Kelly Fisher offers a practical look at artificial intelligence and how accounting firms should be thinking about it.

CPA Practice

APRIL 1, 2024

By Dr. Sangeeta Chhabra Here’s a sobering stat for accountants and business owners alike: 74% of data breaches occur due to human errors, encompassing mistakes, privilege misuse, stolen credentials, or social engineering. But there is hope—through proper training, your firm and ultimately your clients can significantly reduce the risk of a breach. Do staff follow data security policies?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Withum

APRIL 1, 2024

In this episode of Cryptonomix, Mark Eckerle and Anurag Sharma, Partner and Systems & Process Assurance Group Leader at Withum, break down SOC 1, 2, and 3 Reports and the differences between them.

CPA Practice

APRIL 1, 2024

Since 2021, the American Institute of CPAs (AICPA) has spoken out against unscrupulous third-party vendors promoting improper Employee Retention Credit (ERC) claims. The Internal Revenue Service has heeded the concerns of CPAs from across the country and taken steps to curb fraudulent ERC claims. As previously scheduled by the IRS, the voluntary disclosure program has come to an end.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Going Concern

APRIL 1, 2024

Over the weekend, The Times published a bit of a scary article about how the consulting business is so slow over there in the UK McKinsey is now trying to force out some of its engagement managers and associate partners. But they aren’t laying them off right away. McKinsey is offering to pay hundreds of its senior employees to leave the firm and look for work elsewhere, the latest attempt by the consulting giant to reduce staff amid a sector-wide downturn.

Insightful Accountant

APRIL 1, 2024

AI is transforming the tax industry, yet professionals are wary of embracing it fully due to data security, ethics, and client relationships. Practice owners must navigate this shift for success.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

IgniteSpot

APRIL 1, 2024

In the world of entrepreneurship, especially among the do-it-yourself, blue-collar business community, the path to success is often paved with a series of trial and error, hard work, and a never-say-die attitude. Yet, there's an insidious logic trap that many fall into without even realizing it—circular reasoning. This logical fallacy can lead business owners down incorrect and illogical paths, significantly impacting their profits and growth.

Accounting Today

APRIL 1, 2024

This outrageous story about an accountant's client and his wife might not seem like it's real, but it is.

Insightful Accountant

APRIL 1, 2024

Voting for the 2024 International ProAdvisor Awards has begun and will continue through April 30, 2024.

Accounting Today

APRIL 1, 2024

The agency has indicted almost 800 people for COVID fraud, and has a 98.5% conviction rate.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

CPA Practice

APRIL 1, 2024

It has now been more than four years since COVID-19 began ravaging the U.S., but the worst health crisis any of us have ever faced so far in our lifetime hasn’t stopped people from trying to financially take advantage of others. Over the last four years, the IRS Criminal Investigation unit has investigated 1,644 tax and money laundering cases related to COVID fraud totaling $8.9 billion, according to statistics released by the tax agency on March 28.

Xero

APRIL 1, 2024

To further support women’s football worldwide, FIFA has provided 14 Coach Education Scholarships for aspiring female coaches in Aotearoa New Zealand. The scholarships were backed by Xero as part of its global women’s football partnership with FIFA, and ongoing commitment to support the growth of the game and uplift the wahine involved. The 14 female coaches took the first steps on their coaching pathways this month when they joined a female-only OFC C Licence course in Auckland.

Accounting Today

APRIL 1, 2024

From coast to coast, the cities and states where taxpayers procrastinate the most.

Insightful Accountant

APRIL 1, 2024

The countdown has begun, time is almost over. Voting for the 2024 Domestic (US & its Territories) ProAdvisor Awards closes Tonight (April 2, 2024) at 23:59:59 Pacific Time. Cast you vote today, if you haven't already.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Accounting Today

APRIL 1, 2024

City officials attribute the trend to the end of a tax-lien sales program that punishes delinquency.

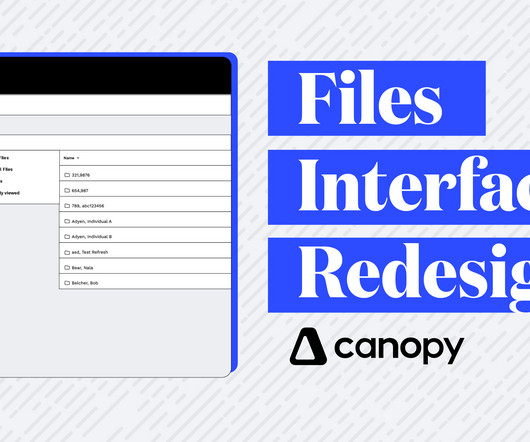

Canopy Accounting

APRIL 1, 2024

What's new: We are thrilled to announce the launch of the Files Interface Redesign within Canopy's Document Management module. This update transforms the way Canopy users interact with the files section, providing a more intuitive and user-friendly experience.

CPA Practice

APRIL 1, 2024

Top 200 accounting firm Stambaugh Ness has acquired Left Brain Professionals, a Westerville, OH-based accounting and advisory firm serving government contractors, effective April 1. Financial terms of the deal weren’t disclosed. In conjunction with the acquisition, Stambaugh Ness has launched an Outsourced Accounting Services (OAS) for Government Contractors practice area.

Dent Moses

APRIL 1, 2024

Expense reimbursement remains a significant challenge for many businesses in the accounting landscape. Manual processes often lead to errors, delays, and employee dissatisfaction. To address these issues, businesses are increasingly turning to software solutions that streamline the reimbursement process and enhance accuracy and efficiency. Expense reimbursement problems are commonly rooted in paper-based systems, which result in lost receipts, data entry errors, and delayed approvals.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

CPA Practice

APRIL 1, 2024

Top 25 accounting firm Withum has merged in BBD, a Philadelphia-based boutique accounting, tax, and advisory firm that primarily serves nonprofit and government organizations, effective March 31. Financial terms of the deal weren’t disclosed. BBD’s five partners and 40 team members have been added to Withum’s roster. What makes this deal convenient for both firms is that they already share an office building, located at 1835 Market St. in downtown Philadelphia.

Accounting Today

APRIL 1, 2024

WithumSmith+Brown added a firm in Philadelphia that mainly serves nonprofit and government organizations.

CPA Practice

APRIL 1, 2024

By Evan T. Beach, EA, CFP, AWMA, Kiplinger Consumer News Service (TNS) “I just want to make sure I don’t go broke and that I leave as much behind as I can.” That’s a line I have heard countless times from people all over the wealth spectrum. Most retirees focus on the number at the bottom of the balance sheet, not necessarily what that number will be after taxes.

Accounting Today

APRIL 1, 2024

If your practice is launching a CAS practice — or you're just in the initial planning and research stages — making sure you're well-prepared is essential.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

CPA Practice

APRIL 1, 2024

By Andrea Cristina Mercado, Miami Herald (TNS) Filing taxes in the United States is a challenging process. Each year, taxpayers grapple with a convoluted, inefficient and perplexing tax filing system. These challenges have an outsize impact on Latino taxpayers, particularly those from low-income, non-English speaking and immigrant households. While individuals of any background face the risk of being targeted by the predatory tax filing industry, Latinos may fall victim to unqualified service pr

Accounting Today

APRIL 1, 2024

Reporting requirements and asset location could loom large for clients seeking greater yield and diversification without thinking through payments to Uncle Sam.

CPA Practice

APRIL 1, 2024

April 1 is a big day at Crowe, as the Chicago-based top 15 accounting firm announced that 52 individuals have been promoted to either partner or principal. This year’s class topped last year’s when 44 professionals at Crowe received keys to the partnership. “On behalf of our management committee, our board, our partners, and the entire firm, I am very proud to congratulate each one of our new partners on this momentous career achievement,” Crowe CEO Mark Baer said in a statement.

Going Concern

APRIL 1, 2024

A belated Happy Easter to those who celebrate and an on-time Happy April Fools’ Day to all. We aren’t planning any shenanigans today so you won’t see any fake stories here today. TBH our brand is still recovering from the great Bitcoin debacle of April Fools’ Day 2014. Plus who can even tell what’s real and what’s fake on the internet these days?

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Anders CPA

APRIL 1, 2024

Every industry goes through down cycles, transportation and logistics included: After the pandemic freight boom, we’ve seen gas prices rise, drivers quit, and operators go out of business. It’s a time when many business owners start to panic, making irrational decisions that can spiral out of control. An owner who sees too many trucks in the yard might accept work at a loss, because they haven’t taken the time to calculate and properly categorize overhead.

ThomsonReuters

APRIL 1, 2024

One of the most important considerations when building a comprehensive practice management solution is ensuring that your systems can communicate with one another. That allows you to gain 360-degree visibility and context into which operational practices aren’t running optimally. How Baker Newman Noyes automated their tax workflow Baker Newman Noyes (BNN), a U.S.

Let's personalize your content