Telecommunication Taxes & Fees by State | TaxConnex

TaxConnex

JULY 25, 2023

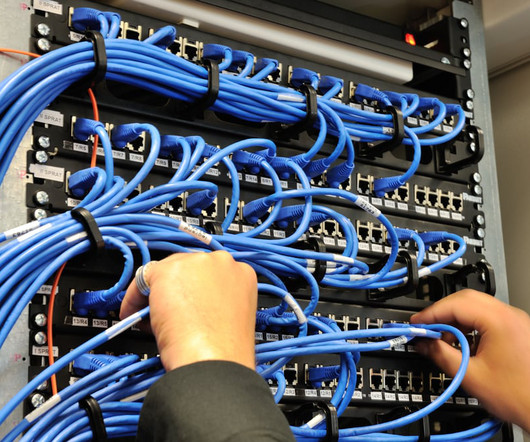

If you’re a telecommunications services company, you face greater trials than other businesses when complying with federal, state and local jurisdictions. In addition to state and local taxes, your business may also be subject to various federal and state regulatory obligations. Federal regulatory obligations are administered through Universal Services Administrative Company (USAC) and state regulatory requirements are administered through the Public Service Commissions (PSC) or Public Utility C

Let's personalize your content