Kill the Audit Industry, Says Ex-Auditor

Going Concern

JUNE 1, 2023

In the WaPo opinion pages yesterday one Duncan Mavin, who got his start in the 90s, says the best way to solve the audit industry’s many conflicts is to kill it altogether. He starts the piece summoning the ghost of Enron, as all writers do when discussing what happens when audit goes wrong. Bringing things back to this decade, he then talks about what’s going on at PwC Australia even though auditors weren’t the ones using confidential government data to bill clients for tax av

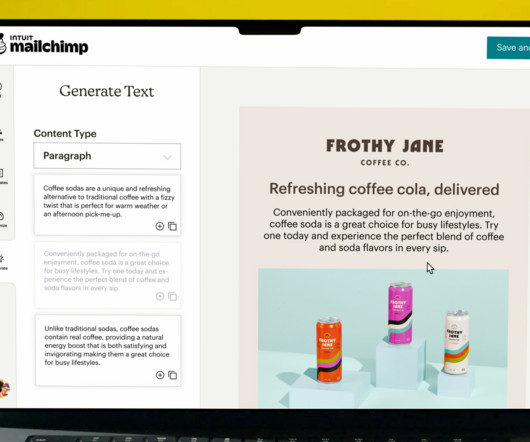

Let's personalize your content