Why Hiring a Tax Pro Boosts Your Small Business (and Saves You Money)

MyIRSRelief

MAY 1, 2024

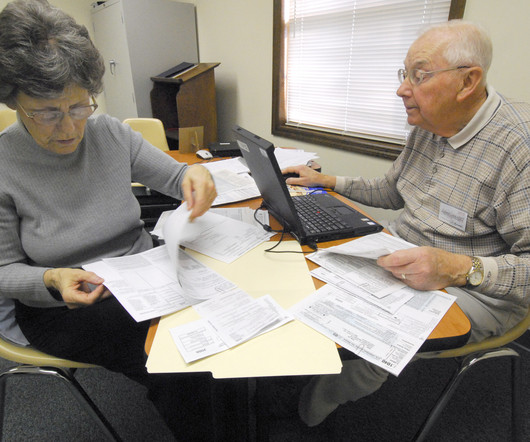

Running a small business is an exhilarating rollercoaster. You’re passionate about your product or service, constantly innovating, and striving for growth. Yet, amidst the excitement lurks a dark alley – the realm of taxes. Navigating complex tax codes, understanding specific forms like 1120, 1120S, and 1065, and ensuring compliance can feel like deciphering ancient scrolls.

Let's personalize your content