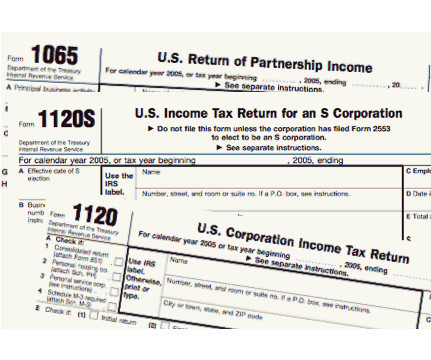

New Sole Proprietors, LLCs, and Corporations Need Accounting and Tax Services

MyIRSRelief

OCTOBER 2, 2023

Starting a new business in Los Angeles area is an exciting time, but it can also be overwhelming. There are so many things to think about, from developing a business plan to marketing your products or services. One of the most important things to consider is accounting and bookkeeping. If you’re new to business, you may be wondering why accounting and bookkeeping are so important.

Let's personalize your content