How the enhanced CTC could impact tax season

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

Accounting Today

MARCH 11, 2024

The fate of the Child Tax Credit is in the hands of the Senate, but the IRS is ready to implement changes rapidly if the bill is passed.

Going Concern

MARCH 11, 2024

The 96th annual Academy Awards went off seemingly without a hitch last night but we’re not here to talk about that because this isn’t a movie blog and I haven’t seen Oppenheimer. We’re here to rehash what happened seven years ago because this website specializes in the beating of dead horses and reminding Big 4 accounting firms of the dumb things they’ve done over the years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

MARCH 11, 2024

By Dave Eisenstadter, masslive.com (TNS) Did you end up unexpectedly owing money on your taxes this year? Statistics from the IRS ending on March 1 indicate you’re not alone. Compared with a similar point in the tax season the previous year, there have been nearly 6 million fewer refunds, IRS records show. By March 3, 2023, 42,040,000 refunds had been issued compared with 36,288,000 by March 1 of this year, a difference of 5.75 million or nearly 14%.

Accounting Today

MARCH 11, 2024

President Joe Biden's budget proposal — which calls for sweeping tax increases on corporations and the wealthy — is the opening round of a looming tax fight set to consume Washington next year.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Insightful Accountant

MARCH 11, 2024

A judge ruled the Corporate Transparency Act's ownership reporting unconstitutional for NSBA and its 60,000+ members by March 1, 2024. This may trigger similar cases nationwide, impacting BOI reporting. Practitioners need to plan their response.

Accounting Today

MARCH 11, 2024

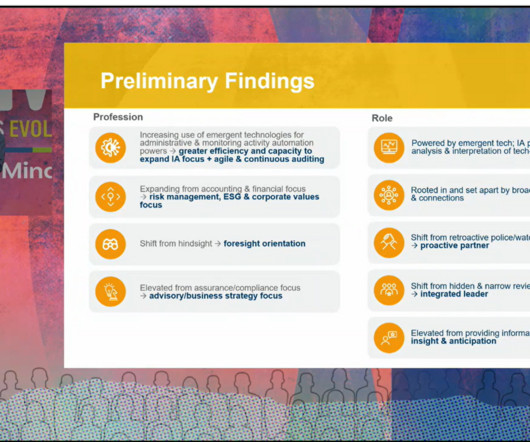

The internal audit function is gaining more people and funding, according to a new survey released Monday during an Institute of Internal Auditors conference in Las Vegas.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

MARCH 11, 2024

With a wealth of ways to move forward and build their practices, accounting firms need to figure of which to take, and which to pass up.

KROST

MARCH 11, 2024

LOS ANGELES, CA – For the fourth year in a row, the Los Angeles Business Journal has named KROST’s Principal, Keith Hamasaki, CPA, a Leader of Influence: Minority CPA. The recognition is dedicated to the works and accomplishments of knowledgeable and skilled accountants in the Los Angeles area. We are extremely fortunate to be in Read the full article.

Accounting Today

MARCH 11, 2024

Senior leaders from Accounting Today's Top 100 Firms and Regional Leaders share the areas where they see the most potential for the profession.

Withum

MARCH 11, 2024

Intuit recently announced the QuickBooks Desktop discontinuation, halting new subscriptions for several QuickBooks (QB) Desktop products after July 31, 2024. This presents an opportunity for the millions of small businesses currently using QB Desktop to upgrade to another, more modern software solution. What We Know About the QuickBooks Desktop Discontinuation Intuit will no longer sell new subscriptions for some of its products: QB Desktop Pro Plus, QB Desktop Premier Plus, QB Desktop Mac Plus

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

CPA Practice

MARCH 11, 2024

The results of The 2024 North American Pulse of Internal Audit Survey , from the Internal Audit Foundation, finds a growing profession, with Chief Audit Executives (CAEs) more than twice as likely to have increased staff (26%) than to have decreased staff (9%). Additionally, after sharp cuts due to the COVID pandemic in 2020 and 2021, significantly more internal audit functions are now increasing their budgets (36%) than are decreasing them (13%), according to the new survey of senior internal a

Insightful Accountant

MARCH 11, 2024

The Bonadio Group climbs to 41st on 2024 Accounting Today Top 100 Firms List, named Top Firm in Mid-Atlantic. Revenue grows over 14% post mergers.

Accounting Today

MARCH 11, 2024

The perception that companies are scaling back their diversity efforts is wrong, according to the AICPA's Crystal Cooke.

CPA Practice

MARCH 11, 2024

By Evan T. Beach, EA, CFP, AWMA, Kiplinger Consumer News Service (TNS) The only thing worse than the monotonous task of preparing your tax return, or preparing your CPA to prepare your tax return, is doing it again on an amended return. We work with retirees to help maximize income, minimize taxes and plan their estate. Below are the six most common mistakes we see retirees make when seeking to minimize their lifetime tax burden.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Accounting Today

MARCH 11, 2024

The Creating Hospitality Economic Enhancement for Restaurants and Servers would provide a tax deduction for bars, restaurants and entertainment venues with draft beer systems.

Canopy Accounting

MARCH 11, 2024

Have questions about accounting practice management software? We cover it all here. Learn what it is, how to use it, and much more!

Insightful Accountant

MARCH 11, 2024

Voting is still open for the 2024 Domestic (US & Its Territories) ProAdvisor Awards and will continue through April 2, 2024.

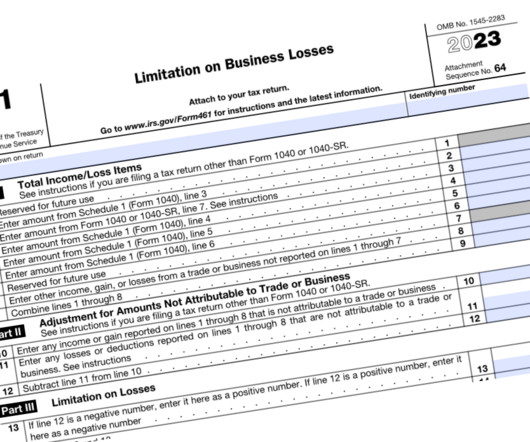

CPA Practice

MARCH 11, 2024

The American Institute of CPAs has sent a letter to the Internal Revenue Service requesting guidance on section 461(l), also known as the limitation on excess business losses (EBLs) of noncorporate taxpayers, enacted under the Tax Cuts and Jobs Act (TCJA). The letter also provides recommendations to help the IRS deliver practical guidance that would be helpful to both taxpayers and tax practitioners.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Xero

MARCH 11, 2024

Over a year ago, we launched an early version of Xero Go to see how a purpose built app could help cater for the entry-level accounting needs of the self-employed in the UK. We have spent the last year testing and refining Xero Go and after completing a careful review to understand the future of the product, we found greater investment was required to meet the changing customer needs and expectations around the product.

Withum

MARCH 11, 2024

Accounting Standards Update (“ASU”) 2022-04 Liabilities – Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Programs is effective for fiscal years ending on or after December 15, 2022, which means it is effective beginning with fiscal years ending on December 31, 2023. The purpose of this ASU is to provide information in the form of note disclosures sufficient to enable users of financial statements to understand the nature, activity during the period, changes from pe

CPA Practice

MARCH 11, 2024

By AJ Hess, Fast Company (TNS) According to outplacement firm Challenger, Gray & Christmas, 84,638 U.S. employers have laid off workers in 2024 so far. Of these layoffs, 15,225 were attributed to a “technological update” and just 383 were explicitly blamed on artificial intelligence. It may be that AI is not yet capable of replacing many workers.

Summit CPA

MARCH 11, 2024

Creative Agency Success Show Podcast Episode 118 In this episode of the Creative Agency Success Show, Jamie and Jody welcome Jack Skeels, CEO of Agency Agile and author of Unmanaged. Jack shares his deep expertise in agency management, offering nuggets on how to unmanage your agency and why layer cakes make a healthy organization. They discuss the complexities of marketing agency management within growing service-based agencies.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Going Concern

MARCH 11, 2024

Hiya! It’s pretty dead out there today. So feel free to review Friday’s Footnotes for a news fix because this one is going to be dry. You can also check out the weekend discussion, this week it was “ Is Everybody Dumb Now? ” Getting right into it… Morale is down at EY UK after a few rounds of layoffs: Staff in EY’s UK deals business have hit out at the company’s management for the way recent job cuts were handled, saying “trust is broken” and that employees feel “de

LSLCPAs

MARCH 11, 2024

The month-end close process is a critical aspect of financial management for organizations of all sizes. It involves reconciling key financial accounts, verifying transactions are captured and in the correct account, and preparing monthly financial statements to provide an accurate snapshot of a organization’s financial health throughout the year.

Cherry Bekaert

MARCH 11, 2024

Contributor: Gabriela Payne, CPA On March 6, 2024, the U.S. Security Exchange Commission (SEC) released final rules on new climate disclosure requirements for public companies. The rules require registrants to provide climate-related information in their registration statements and annual reports. The new climate disclosure rules aim to improve and standardize disclosures about climate issues.

Accounting Insight

MARCH 11, 2024

GAAPweb; one of the UK’s leading specialist sites for Accountancy & Finance jobs , is turning to its valued audience and followers to contribute to their 2024 Salary Survey. Following a year of uncertainty and continued resilience to innumerable economic challenges, GAAPweb strives to investigate and understand the 2024 financial employment market.

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Anders CPA

MARCH 11, 2024

Cannabis entrepreneurs face major challenges when it comes to business financing. Even as recreational use becomes more common throughout the United States, funding options for cannabis businesses will face limited funding options until legalization — or at least rescheduling — occurs at the federal level. Why are banking services limited for cannabis-related business?

Accounting Today

MARCH 11, 2024

A recent podcast included a discussion of time sheets, practice management and the future of the profession.

Withum

MARCH 11, 2024

In this on-demand webinar, learn to navigate the warranty submission process! Already Registered? Click Here View On-Demand Webinar Withum and fellow industry experts, Bass Sox Mercer and The Niello Company participated in a panel event where they discussed the latest trends in warranty reimbursement, tactics of the manufacturer and how dealerships could and should capitalize on warranty rate increases.

VJM Global

MARCH 11, 2024

Held by Hon’ble High Court of Allahabad In the matter of Associated Switch Gears and Projects Ltd. Vs State of U.P. (Writ Tax No. 276 0f 2020 ) The Petitioner received an order for imposition of penalty. Show Cause notice was issued on the ground that the vehicle was traveling to a destination not mentioned in the invoice. However, while issuing the order, the appellate authority has imposed a penalty on a different ground.Hon’ble High Court held that “Show Cause Notice” serves as a vital checkp

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

Let's personalize your content