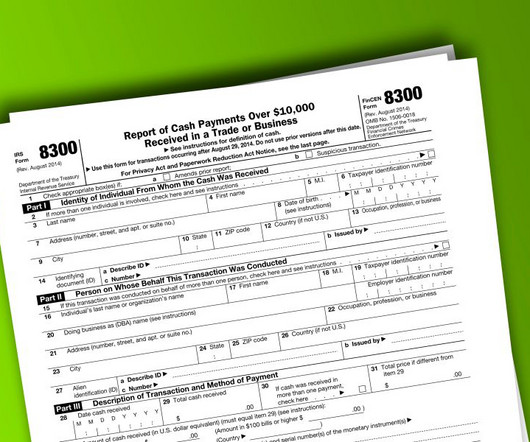

Cash Payments Over $10,000 Must Be Reported Online Beginning 1/1/2024

RogerRossmeisl

SEPTEMBER 4, 2023

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300.

Let's personalize your content