Carbon Accountants: What They Do and Why They Matter

CPA Practice

OCTOBER 27, 2023

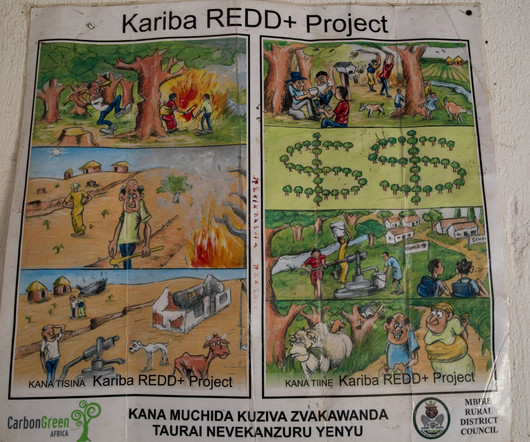

By Allison Arieff, MIT Technology Review (TNS) His official title is vice president of regulated reporting solutions. But really, Billy Scherba, CPA, is a carbon accountant. At Persefoni, a platform for climate management, Scherba works with companies to measure, manage, and disclose their contributions to climate change. Billy Scherba Carbon accountants help companies understand what data matters to their carbon footprint, how to collect that data in a consistent manner, and how to use it to ca

Let's personalize your content