Harvesting Tax Losses

Withum

FEBRUARY 15, 2024

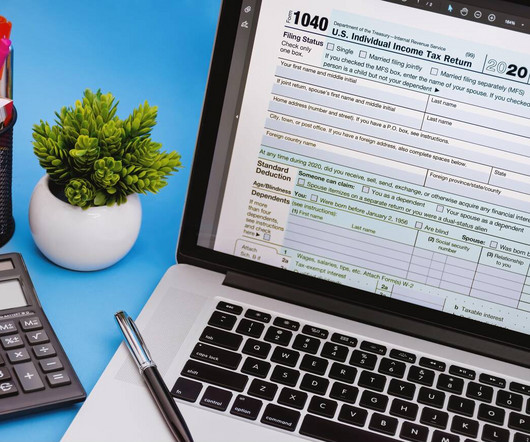

Tax loss harvesting is an income tax planning strategy that involves selling investments at a loss with the intent to offset capital gain income. This strategy is beneficial to taxpayers who have large capital gain income and are seeking ways to lower their related income tax liability. It is important to note that any tax harvesting must be implemented prior to the end of the applicable tax year, which is December 31 st for individual taxpayers.

Let's personalize your content