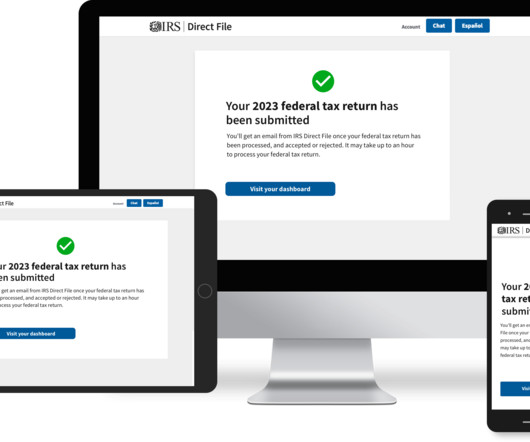

IRS Direct File Pilot Reaches Final Testing Phase

CPA Practice

MARCH 4, 2024

By Sam Becker, Fast Company (TNS) Direct File is going direct. Last week, the Internal Revenue Service (IRS) announced that its Direct File pilot program—which allows some taxpayers to file their returns online for free—would become available to new users in the 12 states where it’s being tested on Monday, March 4, as it enters its final testing phase.

Let's personalize your content