How to build a firm culture that makes a $3M impact

Accounting Today

DECEMBER 28, 2023

Firms of any size can inspire a world-changing culture that starts from the inside of the organization and expands into other spheres of influence.

Accounting Today

DECEMBER 28, 2023

Firms of any size can inspire a world-changing culture that starts from the inside of the organization and expands into other spheres of influence.

TaxConnex

DECEMBER 28, 2023

The new year will no doubt be another active one in sales tax. Let’s look at a few of the likeliest developments. Weaker state revenue The kind of year it’s going to be for state coffers could greatly influence such future sales tax trends as new levies, tougher nexus thresholds and intensifying audits. If so, watch out for 2024. “With more fiscal data coming in, the long-term health of state budgets looks murky,” writes analyst Lucy Dadayan on the site of the Tax Policy Center.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

DECEMBER 28, 2023

I’m breaking my holiday vacation with this news: Attention all CPA Exam Candidates… pic.twitter.com/YwBD3uym2l — NASBA (@NASBA) December 27, 2023 Make sure you check out the comments. The funniest part is they posted this on Tuesday like everything was going to be normal: #CPAExam candidates! Waiting for your score(s)? They will be released tonight at 7 p.m.

CPA Practice

DECEMBER 28, 2023

By Christopher Stark, Founder & CEO, Cetrom. ChatGPT ushered in a new era of automation in accounting (link goes to YouTube), for better or worse. While technology has made many content-based tasks much easier, questions remain about its accuracy and security. This machine learning-powered chatbot with the GPT-3 engine at its core has captivated people’s attention with its rapidly evolving ability to interpret questions and commands to produce generally coherent natural-language responses.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

CTP

DECEMBER 28, 2023

If you are working with a company that sells goods made in the U.S. in foreign markets, you may want to introduce this lucrative tax incentive: the interest charge domestic international sales corporation, more commonly known as the “IC-DISC.” Geared specifically toward American exporters, this incentive helps companies become more globally competitive by lowering their U.S. taxes.

Accounting Today

DECEMBER 28, 2023

The Financial Accounting Standards Board has decided not to add several projects to its technical agenda, including one on commodities, despite requests.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

AccountingDepartment

DECEMBER 28, 2023

Each year, our team gears up to attend events all over the United States that AccountingDepartment.com proudly sponsors. As a proud supporter of Vistage International, Entrepreneurs’ Org, EOS Worldwide, CEO Coaching International, Genius Network, Small Giants Summit, HubZone, Women Presidents’ Organization, and B2B CFO®, our team gets to experience many great events, meet many amazing people, and see our clients from all over.

Accounting Today

DECEMBER 28, 2023

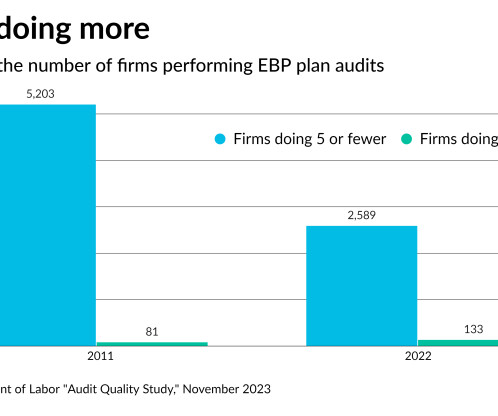

A DOL study uncovered problems in almost a third of employee benefit plan audits — but that's actually an improvement.

GrowthForceBlog

DECEMBER 28, 2023

7 min read As SMEs grow and expand into the middle market, it is usually necessary to upgrade the business's accounting software system to a system that provides more comprehensive enterprise resource planning (ERP) functionality in addition to financial management, traditional bookkeeping, and basic accounting features.

Accounting Today

DECEMBER 28, 2023

Good-bye, sailor; concrete evidence; lack of protection; and other highlights of recent tax cases.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

CPA Practice

DECEMBER 28, 2023

Are you considering a contribution to a Roth IRA or a conversion of some or all of the funds in a traditional IRA to a Roth? The Roth offers the appeal of 100% tax-free distributions in the future, usually in retirement. But the tax exemption isn’t automatic—not by a long shot. What’s more, if you’re below a certain age threshold, you may be slapped with an extra tax penalty on top of the regular income tax you’ll owe on nonqualified distributions.

Accounting Today

DECEMBER 28, 2023

Here's a list of Financial Planning's most important stories in the past year involving the vexing array of complexities with paying Uncle Sam.

SkagitCountyTaxServices

DECEMBER 28, 2023

By the time you actually get to reading this, there is a very good chance that you’re reading a voice from the past. I make it a practice to prepare my Skagit County clients and friends a few days in advance, and RIGHT NOW, it is still 2023. But 2024 is beckoning and is probably already here for YOU. The thing to celebrate is that your Mount Vernon business made it through another year.

Accounting Today

DECEMBER 28, 2023

The Treasury Department and the Internal Revenue Service issued guidance for producers of clean electricity and other forms of renewable energy if they begin constructing projects next year that fall short of the necessary requirements for domestically manufactured components.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CPA Practice

DECEMBER 28, 2023

By Rita Nazareth, Bloomberg News (via TNS). A banner year for stocks is drawing to a close, with gains in big tech leaving the market near all-time highs amid the artificial-intelligence exuberance and dovish Federal Reserve bets. In the run-up to the final closing bell of 2023, the Nasdaq 100 marched toward its best year since 1999 amid a $7 trillion surge.

Accounting Today

DECEMBER 28, 2023

The arguments in Moore v. U.S. carry major potential implications, but these 14 excerpts suggest SCOTUS will deliver a less sweeping decision next year.

Insightful Accountant

DECEMBER 28, 2023

We sat down with Tailor to get his thoughts on being a Top 25 Up-N-Coming ProAdvisor, his journey, path to success, and constant evolution to give their clients the best value.

CPA Practice

DECEMBER 28, 2023

AICPA News is a round-up of recent announcements from the American Institute of CPAs. AICPA & CIMA Registers First 100 Apprentices and Signs 17 Employers to Apprenticeship Program in Inaugural Year The AICPA & CIMA recently announced that it has registered over 100 apprentices in its Registered Apprenticeship for Finance Business Partners program within the inaugural year of the program.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

ThomsonReuters

DECEMBER 28, 2023

But fear not, we’re here to lighten the mood and bring you the top three webcasts that made navigating the twists and turns of the tax and accounting industry a little less taxing (pun intended). Whether you’re a seasoned expert or just starting your career, these webcasts are like hidden gems that will help you shine in the ever-evolving world of tax and accounting.

Accounting Today

DECEMBER 28, 2023

The company said the city used the presence of its Cruise self-driving unit to tie its tax bill to a portion of its global revenue.

CPA Practice

DECEMBER 28, 2023

By Rita Nazareth, Bloomberg News (via TNS). A banner year for stocks is drawing to a close, with gains in big tech leaving the market near all-time highs amid the artificial-intelligence exuberance and dovish Federal Reserve bets. In the run-up to the final closing bell of 2023, the Nasdaq 100 marched toward its best year since 1999 amid a $7 trillion surge.

Accounting Today

DECEMBER 28, 2023

The profession's leaders discuss how they are influencing their potential successors.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

Ronika Khanna CPA,CA

DECEMBER 28, 2023

As we approach the new year, it will be time soon to start working on everyone’s favourite activity i.e. getting your tax stuff in order :). Below are the deadlines that all small businesses need to know for 2024. Download our free Canada unincorporated business tax deadline calendar for 2024 (both Federal and Quebec). Learn more Available at Amazon Interest Rates for Late Tax Filings Due to the increase in interest rates overall, the amount of interest charged on late or overdue balances for bo

CPA Practice

DECEMBER 28, 2023

Process automation is a topic you see everywhere, but what does it mean for your firm? This ebook will help you understand why process automation is so important and a few factors to consider when looking at incorporating more automation into your firm’s daily practices, including: Why process automation is so critical How to know which processes are ready to automate How to get started automating critical processes within your firm Fill out the fields below to get access to this free resource f

CTP

DECEMBER 28, 2023

If your company sells goods made in the U.S. to foreign countries, you will want to familiarize yourself with this tax incentive: the interest charge domestic international sales corporation, more commonly known as the “IC-DISC.” Geared specifically toward American exporters, this incentive helps companies become more globally competitive by lowering their U.S. taxes.

CPA Practice

DECEMBER 28, 2023

The Department of the Treasury and the Internal Revenue Service recently issued proposed regulations to provide guidance for the advanced manufacturing production credit established by the Inflation Reduction Act (IRA). The new Section 45X provides a credit for the production (within the United States) and sale of certain eligible components including solar and wind energy components, inverters, qualifying battery components and applicable critical minerals.

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Accounting Today

DECEMBER 28, 2023

As part of this year's Top 100 Most Influential People survey, Accounting Today asked, "Do you currently mentor someone? What do you get out of it?

Insightful Accountant

DECEMBER 28, 2023

StanfordTax is a "tax 'information' collector" app. It saves both you and your clients time using the power of AI.

Accounting Today

DECEMBER 28, 2023

Honkamp, a Regional Leader based in Dubuque, Iowa, merged in Schowalter & Jabouri, one of the 20 largest CPA firms in the St. Louis metro area, effective Dec. 2, 2023.

CTP

DECEMBER 28, 2023

Are you an exporter? If any of the products that you manufacture, produce, grow, or extract in the U.S. are sold in other countries, you may qualify for a special tax incentive called the interest charge domestic international sales corporation or IC-DISC. The IC-DISC is an election created by the IRS to help American companies become more globally competitive by lowering their federal tax liability.

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

Let's personalize your content