Becoming an Accounting Firm of the Future: The Benefits of Embracing New Technology

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service has updated its frequently asked questions to offer more guidance on what kinds of components can be used in electric vehicles to qualify for tax credits.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

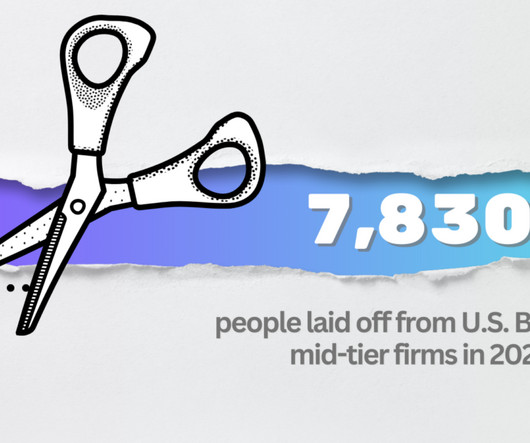

Going Concern

DECEMBER 27, 2023

Today is December 27, assuming there is no accounting firm in the entire country shitty enough to lay people off just days before the end of the year (a generous assumption), we should be able to tally up how many people were shown the door in 2023. These are U.S. numbers for Big 4 and mid-tier firms only, if we missed some get in touch. Also, these layoff numbers include only layoffs that were A) confirmed and B) counted by the firm as layoffs, meaning this year’s aggressive PIP usage and

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service's Exempt Organizations and Government Entities unit has published two new technical guides aimed at nonprofits.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

CPA Practice

DECEMBER 27, 2023

By Adam Lean, Co-Founder & CEO, The CFO Project. In my role as CEO of The CFO Project , a community that helps accountants start and scale CFO/Advisory practices, I’ve noticed that many accounting and bookkeeping firm owners are stuck in what we call The Accountant’s Trap. What is the Accountant’s Trap you might ask? It’s where financial professionals are trapped working long hours for low fees, are forced to deal with high-demanding clients,while being burnt out on compliance and transactio

Accounting Today

DECEMBER 27, 2023

Technology developers who serve the accounting profession share the developments they have planned for 2024.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

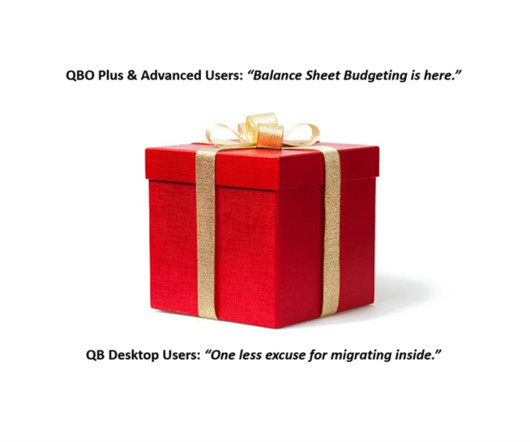

Insightful Accountant

DECEMBER 27, 2023

One less excuse for Desktop Users when it comes to migrating to QBO. There is now Balance Sheet Budgeting available in QBO Plus and QBO Advanced.

CPA Practice

DECEMBER 27, 2023

Do you want to transfer wealth to other family members without dire tax consequences? One of the easiest ways to do it, and one of the most effective, is to simply give lifetime gifts to other family members. If you stay within the tax law boundaries, these lifetime gifts will qualify for the annual gift tax exclusion. And even if you exceed the limits, the remainder is usually covered by the unified estate and gift tax exemption.

Accounting Today

DECEMBER 27, 2023

The IRS-sponsored program relies on hundreds of dedicated accounting volunteers to ensure filers receive the crucial and necessary tax refunds they depend upon and ultimately help people fight poverty and food insecurity.

CPA Practice

DECEMBER 27, 2023

By Katelyn Washington, Kiplinger Consumer News Service (TNS) Following severe tornadoes and storms that began on Dec. 9, the IRS has announced a Tennessee tax deadline extension for affected taxpayers. Eligible individuals and businesses now have an extended tax deadline of June 17, 2024. The extended deadline applies to various tax filings and payments originally due between Dec. 9, 2023, and June 17, 2024.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service has extended some of the deadlines for qualified intermediaries, withholding foreign partnerships and withholding foreign trusts.

CPA Practice

DECEMBER 27, 2023

By Rachel Christian, Bankrate.com (via TNS). As the New Year approaches, many people are addressing financial resolutions. But a significant number of Americans feel like they’re behind on achieving their money goals. About 80% of Americans didn’t increase their emergency savings this year, according to a recent Bankrate survey. Nearly one-third of households (32%) have less emergency savings now than at the start of 2023.

Accounting Today

DECEMBER 27, 2023

Recent data has found that accountants complete the most tasks on Tuesday, and the least on Friday.

Withum

DECEMBER 27, 2023

We no longer have debtor’s prisons, but people deep in debt are prisoners of a sort. Whatever is owed is an encumbrance of your future earnings, and the work you do to acquire funds to repay your debt takes away some of your freedom. In effect, you are placed in a “prison” in that you are working to reduce debt acquired somewhere along the way. One way to avoid this is to not borrow or not take on debt.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CPA Practice

DECEMBER 27, 2023

The American Institute of CPAs recently submitted a comment letter to the U.S. Department of Labor related to RIN 1210-AC02, Retirement Security Rule: Definition of an Investment Advice Fiduciary. The letter states support for the proposed rule, particularly for fiduciary relationships acting in the public’s best interest with respect to any advice to the public.

Accounting Today

DECEMBER 27, 2023

Here's how artificial will really impact accountants and what to do about it.

CPA Practice

DECEMBER 27, 2023

It’s that time of year again. The end of each year is the deadline to take required minimum distributions from funds held in individual retirement arrangements and other retirement plans. The IRS recently sent out a reminder, which applies to taxpayers aged 73 or older (born before 1951), and noted new requirements under the law beginning in 2023. Required minimum distributions , or RMDs, are amounts that many retirement plan and IRA account owners must withdraw each year.

Accounting Today

DECEMBER 27, 2023

CBIZ MHM's Latino-owned business service team has Southern California roots and national ambitions.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

Insightful Accountant

DECEMBER 27, 2023

Stratafolio is an online software solution designed specifically for people who own or manage commercial real estate, use QuickBooks, and want to streamline their operations to save time, increase profits, and reduce manual work.

Ryan Lazanis

DECEMBER 27, 2023

Using various marketing tactics and resources sometimes won't guarantee results. As such, you need to consider this strategy. The post Do This When Your Marketing Isn’t Working appeared first on Future Firm.

CPA Practice

DECEMBER 27, 2023

The Treasury Department and Internal Revenue Service issued proposed regulations just before Christmas for the tax credit for the production of clean hydrogen. The Inflation Reduction Act (IRA) of 2022 provides a production credit for each kilogram of qualified clean hydrogen produced by a taxpayer at a qualified clean hydrogen production facility. The credit amount is dependent on the emissions intensity of the hydrogen production process and the taxpayer’s compliance with prevailing wage and a

Shay CPA

DECEMBER 27, 2023

If you’ve run out of runway and you’re out of options, it might be time to hang up your hat. Don’t fling it onto that hat rack just yet, though. Before you can shut down a tech company (or any company, for that matter), you need to take certain steps. Failing to follow the proper procedures can lead to headaches down the road. We’ve even seen founders have issues crop up years after they shuttered a company.

Advertiser: Paycor

Blue-collar jobs have a branding problem. One company, GEON, partnered with Paycor to find the solution. Learn how to attract, engage, and retain blue-collar employees, helping them build meaningful careers – and support your company’s goals.

CPA Practice

DECEMBER 27, 2023

Retailers have been focused on efforts to mitigate returns, as total returns for the industry amounted to $743 billion in merchandise in 2023, according to a report released today by the National Retail Federation and Appriss Retail. As a percentage of sales, the total return rate for 2023 was 14.5%. According to the report, for every $1 billion in sales, the average retailer incurs $145 million in merchandise returns.

Accounting Today

DECEMBER 27, 2023

In the quest for enhanced corporate sustainability, the integration of innovative technologies is ushering in a new era of reporting capability and transparency.

CPA Practice

DECEMBER 27, 2023

By Kiplinger Consumer News Service , via TNS. Wind Power One beneficiary of the recent federal boost to domestic manufacturing: the wind power sector. The Inflation Reduction Act, passed last year, extends two key renewable energy tax credits through 2024, then replaces them with a slew of others, including the Advanced Manufacturing Production Credit.

Accounting Today

DECEMBER 27, 2023

Income equality; disclosing crypto; meetings are a waste of time; and other highlights from our favorite tax bloggers.

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

CPA Practice

DECEMBER 27, 2023

Christine Maurus Bloomberg News (TNS) Home prices in the U.S. rose for a ninth straight month, reaching a fresh record as buyers battled for a stubbornly tight supply of listings. A national gauge of prices rose 0.6% in October from September, according to seasonally adjusted data from S&P CoreLogic Case-Shiller. A seasonally adjusted measure of prices in 20 of the largest cities also rose 0.6%.

Accounting Today

DECEMBER 27, 2023

The residential landlord with thousands of properties across Germany has been under intense public scrutiny since October 2021.

Accounting Today

DECEMBER 27, 2023

Under the draft proposal from the Treasury Department, hydrogen projects would need to adhere to strict environmental requirements.

Let's personalize your content