Can Payroll Services Handle Direct Deposit?

Patriot Software

FEBRUARY 22, 2024

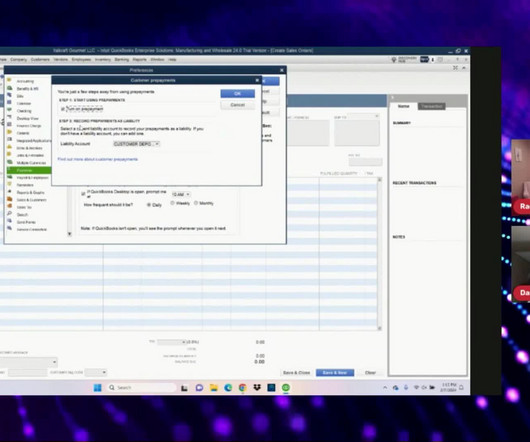

If you want to deposit your employees’ paychecks directly into their bank accounts, you need direct deposit. Direct deposit is a convenient payment method for employees, who receive their paycheck quickly and securely on payday. Most employers handle direct deposit through their payroll software. Payroll services calculate employees’ wages, taxes and deductions, and take-home pay.

Let's personalize your content