How cloud accounting is creating new data opportunities

Accounting Insight

FEBRUARY 27, 2024

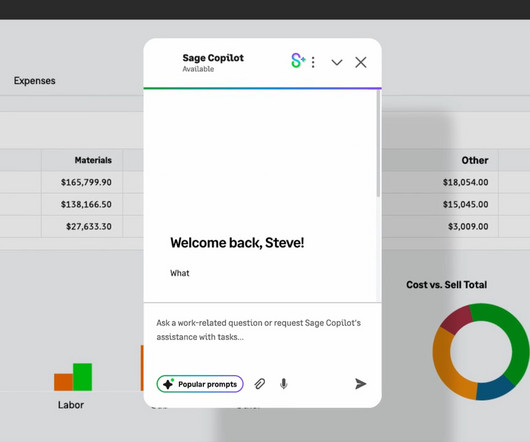

Today, most accountancy practices are alert to the time and cost they can save by migrating to the cloud. Making the shift away from servers has long been attractive to future-focused partners and practice managers keen to grow their firms and maximise efficiency. Like all technologies, however, the cloud has evolved, presenting new opportunities and business uses, particularly concerning data.

Let's personalize your content