Research: The Talent Shortage is Starting to Take Its Pound of Flesh From Corporate Tax Departments

Going Concern

SEPTEMBER 14, 2023

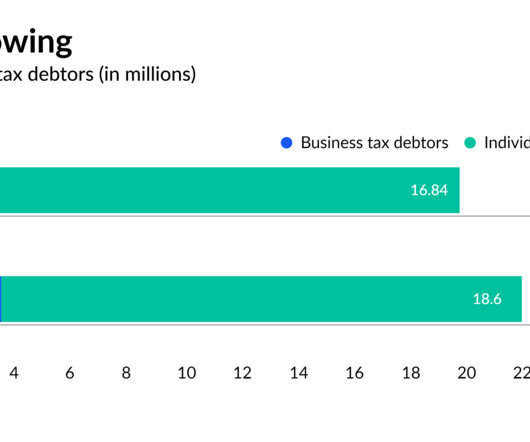

This morning, Thomson Reuters released new research that reveals both corporate tax and global trade departments state they are under-resourced for technology and talent. This, naturally, is increasing risk in the form of penalties and audits. The latest research piggybacks a bit on what was revealed in their Future of Professions report released last month.

Let's personalize your content