Year-End Tax Planning Strategies for Businesses to Prepare for 2024

Anders CPA

NOVEMBER 21, 2023

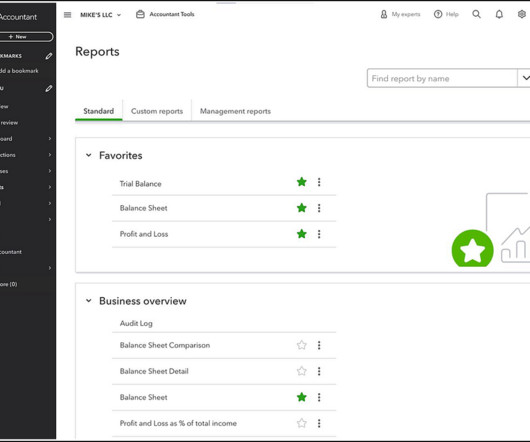

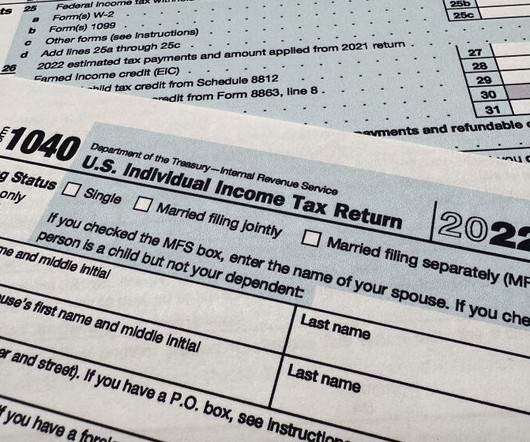

Year-end is approaching fast, which means this is the perfect time for businesses to make some final adjustments to their tax planning strategies. Exploring options such as a de minimis safe harbor election or purchasing assets to take advantage of 2023’s bonus depreciation of 80% could have a big impact on a business’s tax burden come April. Consulting with a trusted tax professional to determine your eligibility for certain deductible activities is the best way to maximize your tax savings.

Let's personalize your content