The Future of Accounting: How Artificial Intelligence is Redefining the Profession

KROST

JANUARY 9, 2024

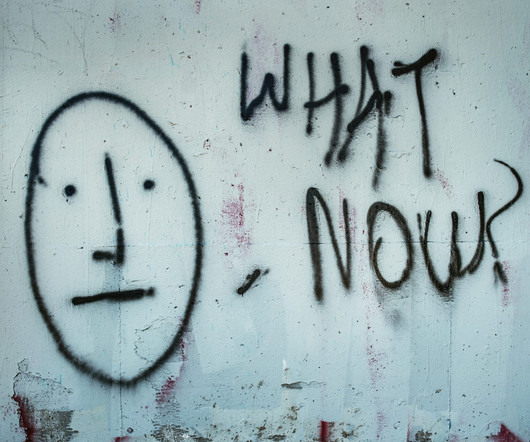

The accounting profession is currently amid a significant transformation, primarily attributed to the rapid emergence of artificial intelligence (AI). It has reshaped accounting in ways previously unimagined. In this article, we will examine the multifaceted influence of AI on the daily activities of Certified Public Accountants (CPAs). Many have used or at least heard of Read the full article.

Let's personalize your content