Do we need accounting firms?

Accounting Today

AUGUST 26, 2022

RogerRossmeisl

AUGUST 28, 2022

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses. Here are some examples. QBI deduction For 2018 through 2025, the qualified business income (QBI) deduction is available to eligible individuals, trusts and estates. But it’s not available to C corporations or their shareholders.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Simple Accounts

AUGUST 19, 2022

You might have heard the term ‘Bank reconciliation’ multiple times but did not bother to go in-depth to find out what it is. If you are someone who is in the business game or who is interested in such details, you might know this. Let us see what it is and how it helps in your business in the simplest way. . Bank Reconciliation: Definition . Bank reconciliation is the process of identifying, comparing, and matching your financial records and bank statements.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Going Concern

AUGUST 1, 2022

Have you heard? There’s an accountant shortage! This is probably coming as a shock to you but it’s true. Firms are trying all sorts of tricks to find and retain talent but the problem may be deeper than not having the right set of perks but rather an actual shortage of qualified talent. This issue has been building since accounting graduate numbers peaked in 2015-16, seven years later we’re starting to see the effects of a shrinking pool of accountants.

Patriot Software

AUGUST 25, 2022

Do you daydream about working with family members? You may consider hiring your child if you’re a small business owner. That way, you can show them the ins and outs of your business and the importance of hard work. At the same time, you gain an extra set of hands to get tasks done (win-win-win!). […] READ MORE.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

RogerRossmeisl

AUGUST 23, 2022

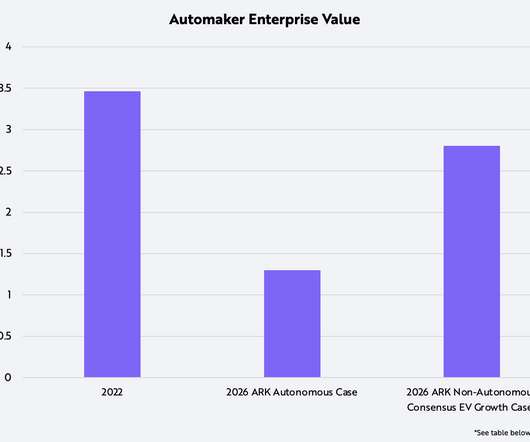

Excerpt of an article posted to the ARK Invest website on 7/15/22 According to the research of ARK Invest, during the next five years the auto industry as measured in units will grow, but as measured by enterprise value, it will shrink. In 2021, the number of light vehicles sold globally was 78 million and the enterprise value of automakers, roughly $3.5 trillion.

Withum

AUGUST 22, 2022

Many organizations have been surprised when they find that cyber insurance premiums have gone up and they now have less coverage. Some organizations are not able to renew their insurance pending proof of meeting the insurance company’s requirements that they have the controls needed to protect and defend themselves against cyberattacks. In another organization, a cyber insurance company denied their renewal because they could not clearly identify their cyber risk which the insurance company stat

Intuitive Accountant

AUGUST 22, 2022

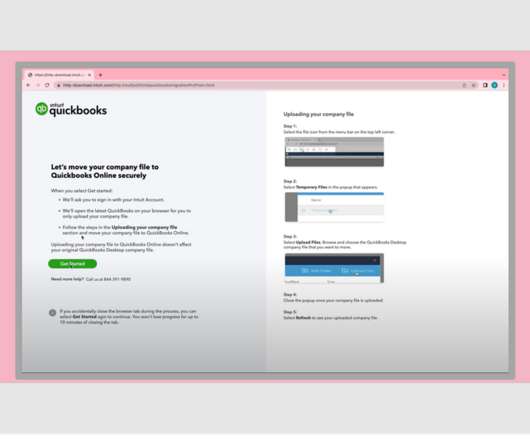

Intuit has been working on a new QuickBooks migration tool for desktop to online. We told you about some of its efforts last spring—now those efforts are full speed ahead with the new tool.

Going Concern

AUGUST 8, 2022

Came across this on r/big4 this morning, let’s remember half of what you see on Reddit is just someone’s creative writing exercise and people who claim to make $200k/yr are often 14-year-old larpers but hey what kind of weirdo would pretend to be a Big 4 manager on the internet. Read on. I don’t think that this is talked about enough, and as a manager, I wanted to give my two cents on what I wish I was told back when starting my career.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Anders CPA

AUGUST 2, 2022

Cryptocurrencies are on the rise, but many investors don’t understand the tax treatment and impacts of these digital currencies. If you’re already investing or looking into investment opportunities, now is the time to familiarize yourself with current tax reporting requirements and wash sale rules before they apply to cryptocurrencies. What is a Wash Sale?

Patriot Software

AUGUST 31, 2022

If you want to pay an employee supplemental compensation, such as a bonus or a relocation payment, you must withhold payroll taxes just like with regular wages. But, what if you want an employee to receive a specific amount after taxes? That is when you gross-up payroll figures. And to do that, you need to […] READ MORE.

RogerRossmeisl

AUGUST 28, 2022

When you take withdrawals from your traditional IRA, you probably know that they’re taxable. But there may be a penalty tax on early withdrawals depending on how old you are when you take them and what you do with the money. Important: Once you reach a certain age, you must start taking required minimum distributions from your traditional IRAs to avoid a different tax penalty.

Withum

AUGUST 25, 2022

On August 24, 2022, the IRS issued Notice 2022-36 to announce broad-based penalty relief for certain failure to file penalties with respect to tax returns for taxable years 2019 and 2020 as long as they are filed by September 30, 2022. The Notice also provides relief from certain information return penalties with respect to taxable year 2019 returns that were filed on or before August 1, 2020, and with respect to taxable year 2020 returns that were filed on or before August 1, 2021.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

Xero

AUGUST 25, 2022

In just a couple of weeks, accountants and bookkeepers from all over Australia, New Zealand and Asia will descend upon Sydney’s International Convention Centre (ICC) for two days of inspiration, education, connection and fun. You guessed it; we’re talking about the return of Xerocon! After a three-year hiatus, we couldn’t be more excited to bring you – our partner community – together again at the world’s most beautiful and innovative conference for cloud accounting leaders. .

Going Concern

AUGUST 17, 2022

What we’re about to share with you shouldn’t be news to anyone and in fact the only news here is that somewhere, 9.1% of public company hiring managers and 14.8% of private company hiring managers are not struggling to find talent. Well that’s what they reported to Deloitte, anyway. Sheryl Estrada writes in Fortune : Deloitte shared new data with me that found 82.4% of hiring managers for accounting and financial positions at public companies said talent retention is a big cha

Anders CPA

AUGUST 2, 2022

After joining INSIDE Public Accounting (IPA)’s list of Top 100 firms at #100 in 2021, Anders jumped 11 spots in 2022 to #89. The IPA Top 100, 200, 300, 400 and 500 recognize the top U.S.-based accounting firms based on net revenues. This is IPA’s 32nd annual ranking of the largest accounting firms in the nation. Anders rose through the ranks of the Top 200 firms for many years and broke into the Top 100 list in 2021 with 2020 firm revenue of $43.5 million.

Patriot Software

AUGUST 30, 2022

Employees love raises. Regular raises can improve employee happiness and put them in a better financial position. And, raises can reduce your employee turnover. You can give raises for merit or increasing job value. You might also give a cost of living raise. Employee raise expectations and employer plans are out of sync. Our free […] READ MORE.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

xendoo

AUGUST 12, 2022

If you’re a small business owner, you know that keeping track of all the moving parts can be challenging. Most small business owners keep track of their profit and loss statement , but the owner’s equity is equally important (and often overlooked). . In this guide, we will explain what owner’s equity is and how to calculate it. We will also give tips on how to grow your equity and protect it from potential risks. .

Withum

AUGUST 30, 2022

On July 8, 2022, the IRS issued a simplified method for taxpayers to obtain an extension to make a portability election. This new publication, Rev. Proc. 2022-3,2022-1 IRB 144 , has superseded the 2017 publication, Rev. Proc. 2017-34,2017-26 IRB 1282. A portability election is an election that allows a surviving spouse to apply a deceased spouse’s unused exclusion, also known as their “DSUE” amount, to be transferred to the surviving spouse for any Federal estate and gift tax purposes during th

Xero

AUGUST 22, 2022

In case you haven’t heard, Xerocon is back with a bang. From London to New Orleans, and soon, Sydney, this year’s event series is an international tour celebrating our partner community around the globe. Whether you’re a first-timer or veteran, it’s safe to say you can expect the unexpected. After all, it’s been coined the world’s most beautiful and innovative conference for cloud accounting leaders for a good reason.

Going Concern

AUGUST 1, 2022

Happy Monday! Here are your headlines. SOX turned 20 over the weekend. SEC Chair Gary Gensler had some things to say about Sarbanes-Oxley’s past, present, and future. Tim Ryan on leadership : “Too often, I find in corporate America, we go into the huddle where we agree on a pass play but not on what routes everybody is running,” he said in a recent interview. “My experience has taught me that one of the enemies of great teams is lack of clarity, on the part of our leaders

Advertisement

Technology evolves at lightning speed, and as finance keeps changing, instant payments emerge as a game-changer for small businesses. By 2030, instant payments are projected to surge by 289% and will become the new norm in financial transactions. Our whitepaper reveals seven must-know facts about instant payments, offering to help you navigate this financial revolution effectively.

Intuitive Accountant

AUGUST 21, 2022

To help you keep up with the many innovative features at Intuit, Liz Scott tells you everything you need to know about the new Quickbooks Online Payroll Employee Details screen.

Anders CPA

AUGUST 30, 2022

The interim Name, Image and Likeness (NIL) Policy has opened many doors for college athletes – including the door that requires annual income tax filings for NIL deals. To deduct some of their expenses against this new form of income, many college athletes have set up LLC’s making their income reportable on Schedule C on their tax return. As self-employed individuals, they are also searching for ways to begin saving for their future retirement.

Basis 365

AUGUST 24, 2022

Many organizations are now at greater risk due to the dramatic increase in people who work from home. Therefore, you and your employees must take steps to protect sensitive data in your company and its privacy. You can start by ensuring everyone in your team is aware of these best practices for data protection when working remotely. 1.Keep your devices patched up and current You can prevent your devices from becoming vulnerable by setting aside time each week for security updates.

Withum

AUGUST 18, 2022

Some meetings go on and on and on, and some are held with strong control by the presiding person. Here are some tips to speed meetings along effectively and efficiently by not letting them get hijacked. . First off, this applies equally to in-person and virtual meetings. Running them should be done in a similar manner. Effective and Efficient Meeting Tips.

Advertisement

"Offer payroll and do it yourself,” they said. “It’ll be fun!” Spoiler alert: It was not fun. Most CPA firms know that they need to offer payroll services to their clients or risk losing them to another firm that will. However, many don’t really want to. It is often time-consuming and complex due to changing tax laws and regulations, and with the growing staffing shortages, most just don’t have the resources.

CTP

AUGUST 18, 2022

For tax professionals in particular, one pro tip has the potential to alleviate stress and accelerate your business growth: that is to start a joint venture. A joint venture allows you as a tax planner to focus on your strengths by coming together with a business partner who is strong in areas where you may be weaker. This symbiotic relationship can ramp up both of your businesses and reduce the frustrations that can come with trying to “do it all.”.

Going Concern

AUGUST 26, 2022

Because the IRS SWAT team memes your crazy aunt Kathy is spreading on Facebook are getting out of control, the AICPA has stepped forward to clarify: no, there will not be 87,000 armed IRS agents deployed to bang down the doors of American taxpayers. From the Journal of Accountancy : Reaction to increased funding for IRS operations in the Inflation Reduction Act, P.L. 117-169, enacted Aug. 16, has featured “heated rhetoric,” but the act has also prompted real concerns regarding how th

Intuitive Accountant

AUGUST 30, 2022

ADP VP of Government Relations Pete Isberg explains how the tax credit can help your small business clients save money and better compete in today's ever-competitive landscape.

Dent Moses

AUGUST 16, 2022

Valuations for most businesses have dramatically increased over the last few years. There is plenty of activity and cash in the M&A market. Industries (like engineering) have become targets for venture capital pushing valuations even higher. Many of the buy-sell agreements were set up when the business started, sometimes decades ago, and are no longer appropriate.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Let's personalize your content