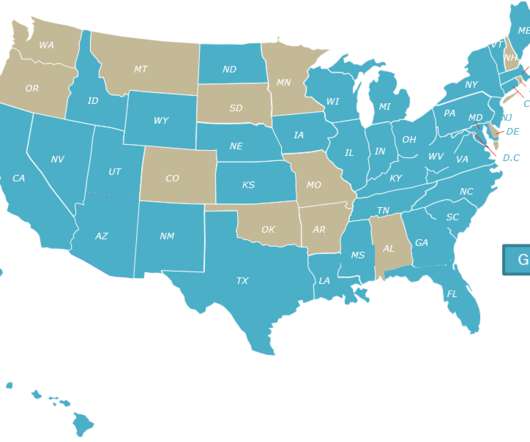

Unexpected Growth Can Mean Sales Tax Obligations

TaxConnex

MAY 4, 2021

This article was written for the Atlanta Business Chronicle Leadership Trust. To see the original post, click here. Every business owner wants their company to grow. And when that growth is unexpected, it feels that much sweeter. But don’t forget that success that comes from selling into more states can also expand your sales tax burdens. Businesses that sell into multiple states or jurisdictions have to pay attention to sales tax thresholds, and it’s not a one-time project.

Let's personalize your content