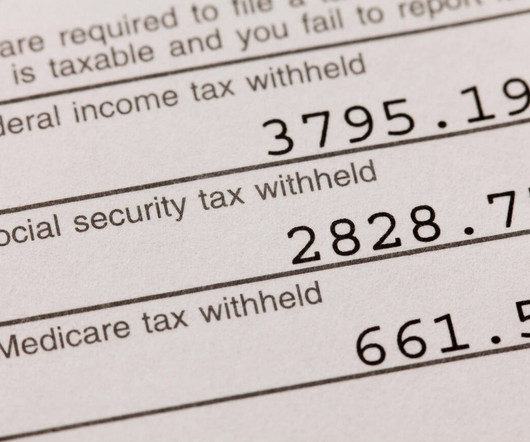

Meeting the Staffing Demands: How Automation is Transforming Accounting Firms

CPA Practice

OCTOBER 10, 2023

By Richard Lavina and Ralph Carnicer. The demand for skilled tax practitioners in the accounting profession has never been more critical. With the continuous growth in the IRC’s complexity and the rising number of tax filings each year (at both the federal, state, and local levels), the likelihood of making an inaccurate filing is increasing to unprecedented levels; which in turn is stretching industry talent dangerously thin.

Let's personalize your content