Retaining Accounting Talent Starts With Knowing These Top 3 Job Search Motivators

CPA Practice

MAY 9, 2023

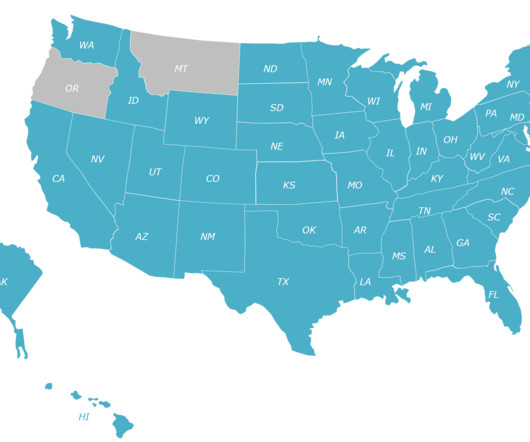

You may have heard that job openings in the United States dropped significantly in February, falling below 10 million for the first time since May 2021. But if you study the Bureau of Labor Statistics (BLS) data a little more closely, you’ll find that quits also edged up slightly that same month to 4 million. Further examination of BLS data shows monthly quit rates have been on a downward trend generally over the past year.

Let's personalize your content