7 min read

Just like any other organization, Nonprofits of all types are susceptible to fraud. In fact, Nonprofits are even more susceptible to fraud because they oftentimes do not have the resources to help prevent and properly recover from fraudulent activity.

|

Key Takeaways

|

When a nonprofit leader meets someone who wants to work or volunteer for them who is just as excited about the mission as they are, it can be easy to get swept away and immediately put too much trust into a person they barely know – simply because they claim to share the same values as the nonprofit.

Unfortunately, there are dishonest people in the world, which puts everyone, including nonprofit organizations, at risk of fraud.

Nonprofit Fraud Statistics

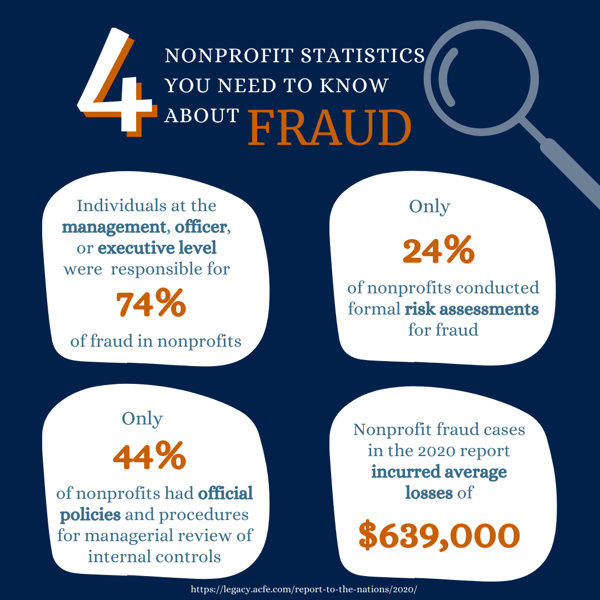

If you don't believe your organization is at risk, consider these findings regarding fraud in nonprofit organizations from the most recent Association of Certified Fraud Examiners' 2020 biennial update to its Report to the Nations [1]:

- Nonprofit fraud cases in the 2020 report incurred average losses of $639,000.

- Individuals at the management, officer, or executive level were responsible for 74% of fraud in nonprofits

- 57% of nonprofits had a department for internal auditing, compared to 76% of other organizations.

- Only 21% of nonprofits conducted surprise audits compared to 40% of other organizations.

- Only 24% of nonprofits conducted formal risk assessments for fraud, compared to 43% of other types of organizations.

- 44% of nonprofits had official policies and procedures for managerial review of internal controls compared to 68% of other organizations.

According to the report, the top three reasons why nonprofits fall victim to fraud were lacking internal controls, failing to review and improve existing internal controls, and overriding existing controls (deciding not to follow the rules).

How to Detect Fraud in an Organization

Depending on how skilled a fraudster is, fraud that's occurring in an organization might be obvious or it might be extremely difficult to detect. Establishing the following policies and procedures in your nonprofit, however, can help ensure you detect and put an end to fraud almost as soon as it starts.

Establish Detective Controls

Detective controls are policies and procedures that are designed to help you detect fraud before it potentially goes on for years, costing your organization thousands of dollars and invaluable reputational damage. Some examples of detective controls include surprise audits and inventory counts, independent reviews of your vendor list and billing statements, and having an employee outside of your bookkeeping and accounting department responsible for reconciling bank and credit card statements.

Collect and Save Expense Receipts

It's absolutely essential that you have a rigid policy and procedure around collecting expense receipts – especially for charges to your nonprofit's credit accounts. These need to be scrupulously reviewed and reconciled against your account statements for accuracy.

Internal Audits

You should regularly conduct internal audits. It's best, however, not to make these regular audits routine. They should pop up unexpectedly so that anyone in the middle of committing a theft or fraud does not have time to cover it up. Members of your financial committee can take turns performing the audits.

Better yet, your organization can hire an outside auditing company to perform them unbiasedly on your behalf because fraud detection in a nonprofit can be extremely difficult to unearth – especially if you do not have a professional auditor combing through your accounts and ledgers.

Read More: 5 Steps to Help Nonprofits Run Better, Grow Stronger, and Raise More Money

Establish a Whistleblower or Tip Hotline

You can subscribe to third-party hotline services that allow you to set up a phone number or email address that employees can contact anonymously to report suspected fraud, air any suspicions they might have, or maybe even confess their own wrongdoings.

Require Job Rotation and Vacation

When an employee conducts fraud, they often need to make ongoing adjustments to conceal the crime. Rotating responsibilities among your staff and/or requiring that your staff take vacations (at least one to two weeks of consecutive time) will make it way more challenging for them to hide a fraud that has been committed. The issues will either be discovered by the next person who takes over their current responsibilities or the crime will come to light when they are away from the office.

How to Prevent Fraud in Your Organization With Nonprofit Internal Controls

No organization can ever be completely shielded from the risk of fraud. However, when it comes to nonprofit fraud prevention, you can take steps to reduce your nonprofit's exposure and the risk that it will fall victim to fraud.

Create a Fraud Policy and Code of Conduct

You should have clearly defined policies in place regarding fraud in addition to an employee code of conduct. These documents should be part of your employee and/or volunteer onboarding and training process so that your expectations and all employee/volunteer responsibilities are 100% clear from the start.

When developing these policies and documents, it is advisable to consult with a lawyer to ensure the policies are legally sound and will work to protect you, your organization, and your employees and volunteers.

Establish Preventive Controls

Your bookkeeping and accounting procedures should be made secure and help prevent fraud by ensuring that no single person has too much power or control over entire financial transactions or several important parts of a financial transaction. You can implement checks and balances and separation of duties that limit the opportunity for fraud to occur in your nonprofit. The following financial duties should be set up with dual control procedures:

- Deposits - The person who records deposits should not be the same person handling deposits.

- Banking - Authorized signers should not also have access to accounting/record-keeping programs.

- Payroll - Timesheets should be looked over and approved by one person before another person prepares the payroll.

- Purchases - An individual who is authorizing purchases should not be responsible for managing accounts payable.

- Account Reconciliation - Bank and credit card statements should not be reconciled by any individuals who are holding credit cards or who are responsible for managing payables or receivables.

Additionally, you should implement physical preventive controls to limit opportunities for fraud. These types of controls involve the need for the physical security of your office. You should keep blank checks locked up with limited access. Additionally, set limits to the payable amounts that any one employee can authorize and require more than one signature on checks.

Read More: What Nonprofits Can Learn From the Best Well-Run Businesses (and Vice Versa!)

Prosecute Offenders

Nonprofit organizations that fall victim to fraud are often wary to report and prosecute offenders for fear of suffering reputational damage if the offense goes public. Failing to prosecute, however, sends the message that future offenders who might be caught won't suffer consequences, either. It also leaves past offenders free to commit similar crimes in their next professional positions.

When you prosecute, you get justice, you prevent the fraudster from repeating crimes, and you toughen the image of your organization, protecting it from would-be fraudsters in the future. Prosecuting is a win-win-win. Plus, if you're worried about your organization's reputation suffering damage, consider this: having prosecuted a criminal looks much more respectable than not having taken action when the fraud your organization suffers inevitably comes to light anyway.

Safeguard Your Nonprofit From Fraud With Outsourced Accounting Services

Another great strategy for preventing fraud and ensuring any internal fraud is swiftly detected is to outsource your organization's bookkeeping and accounting functions to a third-party financial services provider.

With outsourced accounting services, you'll have a completely secure accounting system established on your behalf by a professional, highly experienced controller. Additionally, you'll have a team of accountants and bookkeepers at your disposal who can ensure your receivables and payables are processed properly, your payroll is completed accurately, that you have internal audits performed routinely, and that your accounts are safely reconciled each billing period.

An outsourced provider is an affordable way for nonprofits to access the benefits and capabilities of a high-powered in-office accounting team without the high cost of hiring full-time accounting professionals. Plus, your back office will be even more secure than an in-house bookkeeping and accounting department because you'll be working with highly vetted third-party professionals, which shifts the risk of fraud from your back office to your outsourced accountant's back office. As a result, you can stop worrying so much about safeguarding your nonprofit and start focusing more on your mission.