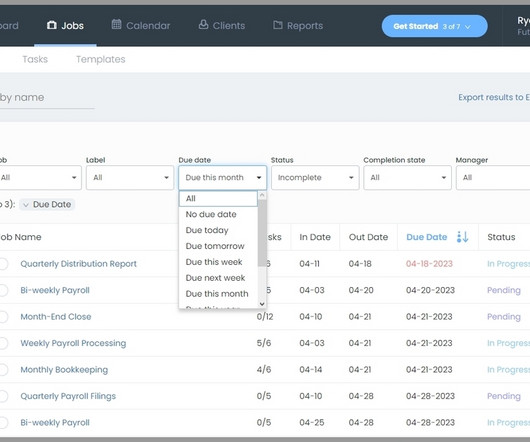

New Products at QuickBooks Connect Help Accountants Drive Small Business Growth

CPA Practice

NOVEMBER 14, 2023

At this year’s QuickBooks Connect conference in Las Vegas, Nov. 13-15, more than 2,500 accountants learned about many new product and feature innovations that will help them serve their clients through the QuickBooks Online ecosystem. Learn more about QuickBooks Ledger. Together, we’re unlocking new ways to power prosperity.”

Let's personalize your content