Certified Management Accountant Certification: What Is It, and Should You Get It?

Patriot Software

AUGUST 19, 2022

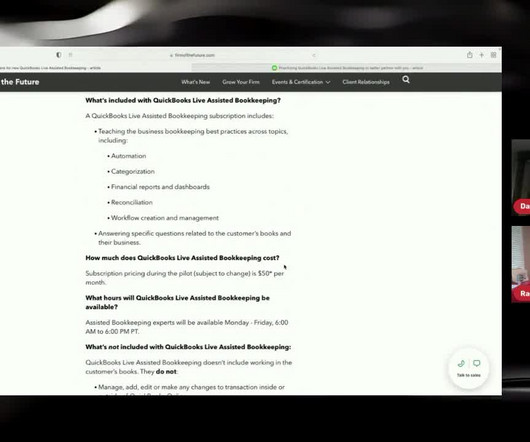

If so, you might be interested in getting your certified management accountant certification. Are you an accounting professional hungry for new accolades, knowledge, and ways to stand out from the competition? You can expand your financial planning and strategic financial management skills through this CMA certification.

Let's personalize your content