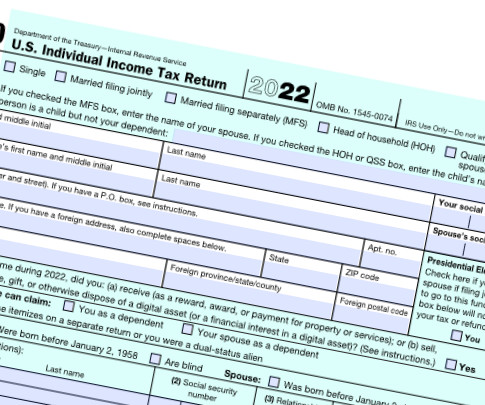

Federal Income Taxes Are Set To Skyrocket

Withum

JUNE 12, 2024

S Corporation shareholders and partners in a partnership could see their effective federal income tax rate increase by 30% by the end of December 31, 2025, due to the expiration of certain tax laws. A dramatic increase to the effective tax rate may catch many pass-through entity businesses by surprise.

Let's personalize your content