How the 50 States Rank By Tax Burden

CPA Practice

APRIL 3, 2024

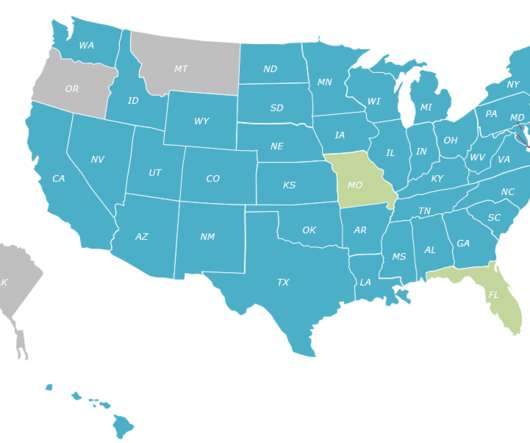

Unlike tax rates, which vary widely based on an individual’s circumstances, tax burden measures the proportion of total personal income that residents pay toward state and local taxes, according to WalletHub. Maine has the highest property tax burden, while Alabama has the lowest. 1 being the highest and No.

Let's personalize your content