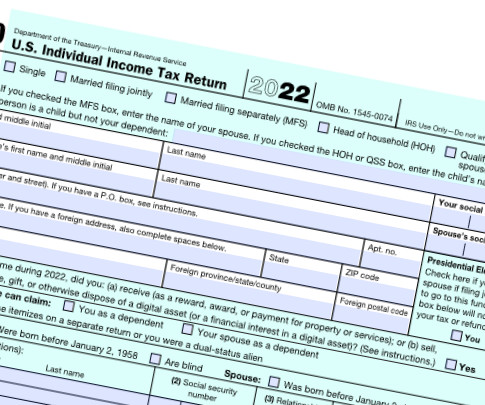

Marcum Offers 2023 Year-End Tax Guide

CPA Practice

NOVEMBER 16, 2023

With the tax landscape continually evolving, Marcum LLP has released its 2023 Year-End Tax Guide. The guide features a detailed analysis of the current tax environment and spans more than 135 pages. The tax guide is available at [link]

Let's personalize your content