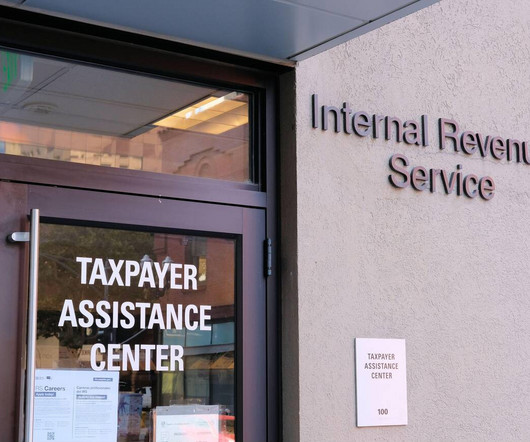

Several Taxpayer Assistance Centers to Have Saturday Hours, IRS Says

CPA Practice

FEBRUARY 16, 2024

24, and more than 70 offices are scheduled for the March 16 event. These Saturday hours are designed to help those with busy weekday work schedules get the help they need at a time more convenient for them,” IRS Commissioner Danny Werfel said in a statement. To make an appointment during regular hours, call (844) 545-5640.

Let's personalize your content