Hot Topics: Economic Nexus Thresholds and Reporting Requirements | TaxConnex

TaxConnex

JANUARY 18, 2024

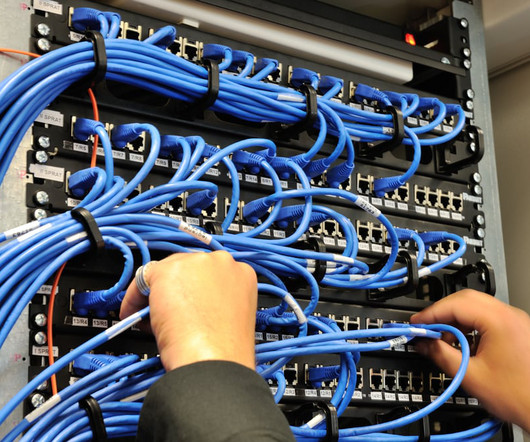

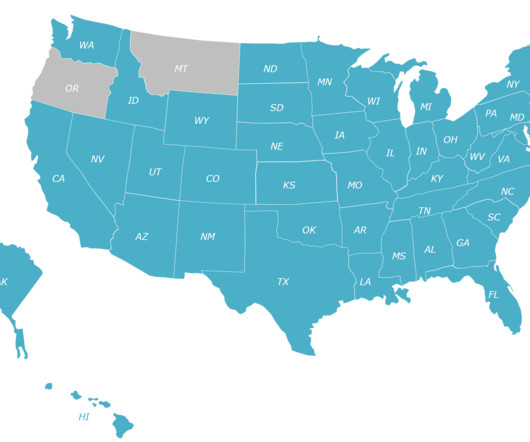

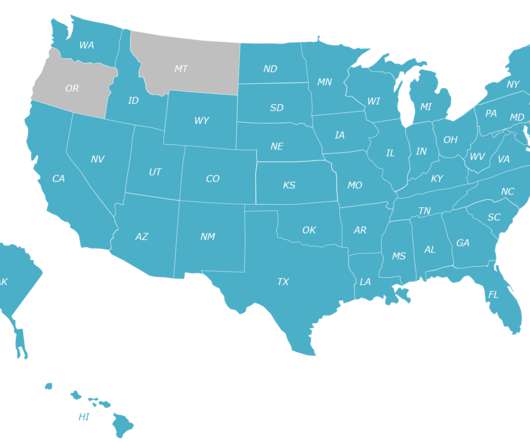

What’s the latest brewing today in sales tax? Supreme Court’s Wayfair decision largely opened sesame for states to begin economic enforcing nexus thresholds. Physical nexus standards – such as having offices, staff or inventory in a state – had long mandated that retailers had to collect and remit a state’s sales tax.

Let's personalize your content